Last Updated on October 5, 2022 by Rebecca Lake

30-30-30-10 Budget (or 30 30 30 10 Budget Rule)

Have you struggled to find a budgeting method that allows you to pay your bills while still having a life?

Making a budget is important for your financial health. But finding the right budgeting system matters.

The 30-30-30-10 budget could be right for you. This budgeting system builds “fun” into your spending each month, along with paying essential expenses.

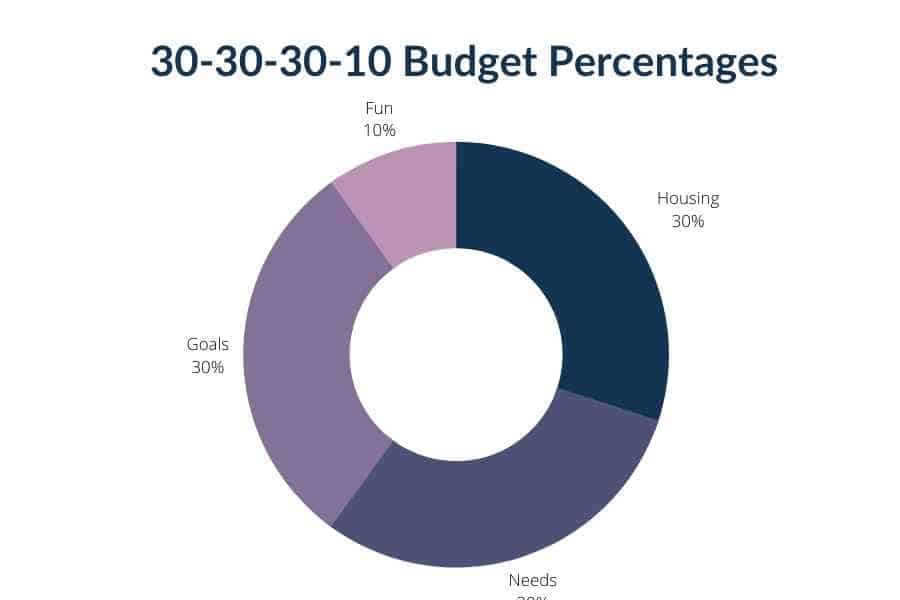

Specifically, when you budget this way you allocate your money into four different buckets:

- Housing

- Needs/Essentials

- Goals

- Wants/Fun

Sounds easy enough, right?

The 30 30 30 10 budget rule could work for you if you want to take a simple approach to budgeting.

Keep reading to learn:

- What is the 30-30-30-10 budget rule

- How to budget using the 30 30 30 10 method

- How the 30 30 30 10 budget compares to other budgeting options

Related post: How to Make a Budget (When You Hate the Idea of Budgeting)

LIKE FREE MONEY?

Here are some of my go-to apps for earning extra cash!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid, no special skills or experience required!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

What Is the 30-30-30-10 Budget?

The 30 30 30 10 budget is a system for budgeting by percentages.

When you use budget percentages, you assign different percentages to your income each month.

This means instead of assigning dollar amounts to individual expenses the way you would with zero-based budgeting, you assign money to buckets or categories instead.

The number of buckets can depend on the budget percentages method you’re using.

With the 30-30-30-10 budget, there are four. But some budgeting percentages methods use 3 instead while Dave Ramsey budget percentages uses 11.

Related post: Dave Ramsey Budget Percentages Explained

How the 30 30 30 10 Budget Rule Works

Wondering how this budgeting system works?

Good news! The 30 30 30 10 budget is not complicated at all.

Here’s how it works:

- Add up your income for the month

- Add up your expenses

- Set your financial goals

- Divide your expenses into four categories

- Calculate how much of your income goes to each category

Again, there are four categories or buckets in the 30-30-30-10 budget: housing, needs, goals and wants.

Here’s a closer look at how each bucket works.

30% for housing

The 30 30 30 10 budget dictates spending 30% of your income on housing each month. That includes:

- Mortgage or rent payments

- Homeowners or renter’s insurance

- HOA fees

- Appliances

- Transportation

You might include property taxes and HOA fees here as well if you own a home and those expenses aren’t rolled into your mortgage payment.

So, is this realistic?

The 30% rule–which says you should spend no more than 30% of your income on housing–dates back to the 1960s.

Whether 30% of your income for housing is a good number can depend on where you live and how much you make. As rent prices rise, more households are becoming rent cost-burdened, meaning they spend more than 30% of their income on rent.

But if you can stick with 30% or less for housing, that leaves you with 70% of your income for other expenses.

Related post: Cash Envelope System for Beginners (Get Started in 3 Easy Steps)

30% for needs/other expenses

The next part of the 30-30-30-10 budget covers essential expenses other than housing.

So that means things like:

- Utilities

- Groceries and food at home

- Internet and phone service

- Essential clothing

- Insurance (i.e. health, dental, life, etc.)

- Childcare

- School-related expenses

- Pet care expenses

This budget percentage covers the things you need to pay to maintain a basic standard of living. In other words, these are your “needs”.

30% for financial goals

Setting goals for your money matters. And you probably have at least a few financial goals you’re working toward.

The next part of the 30 30 30 10 budget involves budgeting for your goals. So those might include:

- Paying off credit cards, student loans and other debts

- Building your emergency fund

- Saving and investing money for retirement

- Setting aside money for your kids to pay for college

- Creating a vacation or new furniture fund

- Saving money for home repairs or renovations

- Starting a business or side hustle

By putting savings, debt repayment and other goals into one bucket you can prioritize both. That’s a plus if you struggle with the question of whether to save or pay down debt first.

Related post: 23 Money-Saving Charts for Crushing Your Financial Goals

10% for wants/fun

The last part of the 30-30-30-10 budget earmarks 10% of your income for wants or “fun” spending.

So you can use this part of your budget for things like:

- Streaming subscriptions

- Dinner out

- Entertainment

- Books (my personal favorite splurge!)

- Nonessential clothing

- Toys for the kids

- Vacations or travel

In other words, these are things you don’t need to spend money on to live. But they’re the “nice to haves” in your budget that keep you from feeling like all your money goes to bills and debt.

Related post: 10 Easy Ways to Simplify Your Budget and Finances

30-30-30-10 Budget Example

Need an example of what a 30 30 30 10 budget looks like?

Let’s assume you bring home $5,000 a month. If you’re following the 30-30-30-10 budget rule, here’s how you’d divide it up:

- $1500 for housing (30%)

- $1500 for needs (30%)

- $1500 for goals (30%)

- $500 for fun (10%)

This is one of the easiest budgeting methods to follow because you can easily calculate how much you can spend in each category or budget.

And because you’re building both financial goals and fun into your budget, you can pay your bills and get ahead without feeling deprived.

30-30-30-10 budget calculator

Having a calculator can make budgeting so much easier!

Instead of spending hours stressing over how to make a budget, you can knock one out in minutes with a budget calculator.

I searched the web high and low for a 30 30 30 10 budget calculator but unfortunately, I wasn’t able to find one.

You can, however, use a general budgeting percentages calculator to plug in your income. From there, you can see at a glance how much you should be spending on different expenses each month.

Calculate your budget percentages here.

How to Make a 30-30-30-10 Budget

If you want to put the 30 30 30 10 budget to work, don’t stress!

Here’s how to do it step by step.

1. Add up your income

To make a 30-30-30-10 rule budget (or any budget) you first need to know how much you’re bringing in each month.

So start by adding up all your income, including:

- Paychecks from a 9 to 5 job

- Income from a part-time or second job

- Money earned from side hustles

- Business income if you have any

- Child support or alimony (if that applies to you)

- Government payments you receive regularly

The key here is to know exactly what you have in net income. This is how much you actually have to pay your expenses after taxes are taken out.

2. Add up essential expenses

Once you know how much money you have to budget, you can add up your expenses.

For now, focus just on your essential expenses. So that means:

- Housing and related costs

- Utilities

- Groceries and food

- Insurance

- Clothing

- Childcare

Include everything you need to pay each month to maintain your household.

Leave out the wants or extras, though. You’ll budget for those later.

3. Set your financial goals

Next, think about what your goals are for your money.

Again, that can include saving and paying down debt. For this part of making a 30-30-30-10 rule budget, it helps to be as specific as possible.

So instead of saying I want to pay off my credit card, you might say something like, I want to pay $200 a month to my card so it’s paid off in 10 months.

The same goes for savings.

So rather than setting a vague goal of adding to your emergency fund, you might set a goal of saving $100 a month.

The more specific you can be the better. This can help you decide what to do with your money in step 4.

4. Divide your income

If you have your income, expenses and goals ready, then you can move on to the most important part of making a 30 30 30 10 budget.

This is where you’ll divide up your income into each budget percentage.

So again, let’s say you make $5000 a month. Your budget would look like this:

- $1500 for housing (30%)

- $1500 for needs (30%)

- $1500 for goals (30%)

- $500 for fun (10%)

What you have to decide is how to spend the money in each of those buckets.

So, say you have $1500 to pay for needs. That $1500 has to cover all of your essential expenses.

But what if your needs add up to $2200?

There are a few ways to handle it. First, you could look at your needs category to see what expenses you could cut back or get rid of.

If you need some help with that, Trim and Billshark are two great tools for saving money on bills.

Trim helps you find wasted money in your budget and cuts those expenses out. Billshark negotiates your bills down for you.

Another option is taking money away from another category to put toward essentials. But that kind of defeats the purpose of the 30-30-30-10 rule budget.

So a third option is to find ways to make more money.

You could do that by asking for a raise at work or getting a part-time job. Or you could try starting one or more side hustles to bring in more money.

Need some side hustle ideas? Here are 30+ easy ways to make an extra $1000 a month!

Related post: How to Teach Budgeting to Kids

30 30 30 10 Budget vs. Other Budgeting Methods

The 30-30-30-10 budget rule isn’t the only way to budget your money using percentages.

If you’re trying to decide which budgeting method to use, here are three others you might consider.

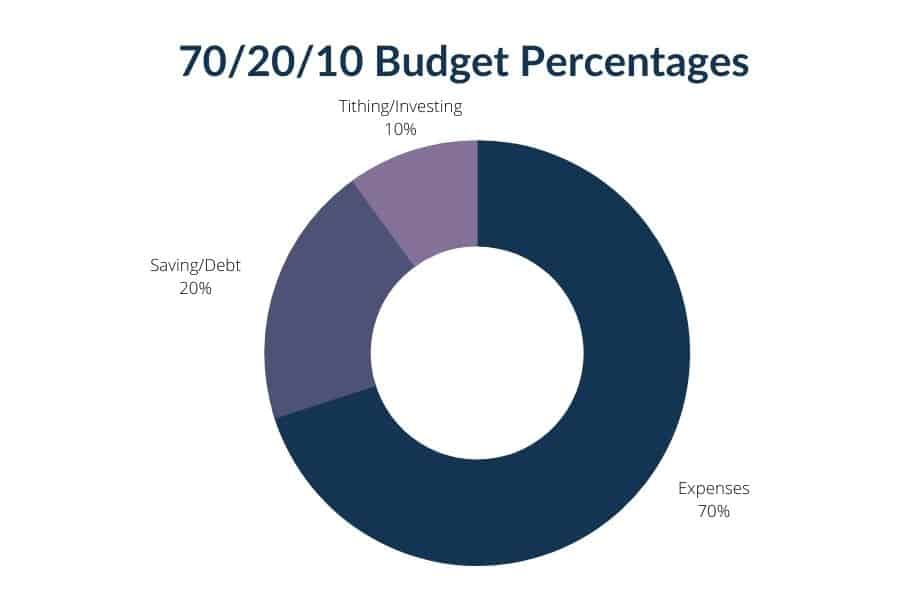

What is the 70 20 10 rule money?

The 70 20 10 rule money encourages you to divide your income into three categories:

- 70% for expenses

- 20% for saving and debt repayment

- 10% for tithing/charitable giving and investing

You might like this budgeting method if you:

- Want to group housing and expenses together

- Would rather earmark less of your budget to saving and debt repayment

- Want to specifically include giving and/or investing in your budget

Making a 70-20-10 rule budget is similar to making a 30 30 30 10 budget; you’re just dividing up your income differently.

Here’s a complete guide to how the 70 20 10 budget rule works.

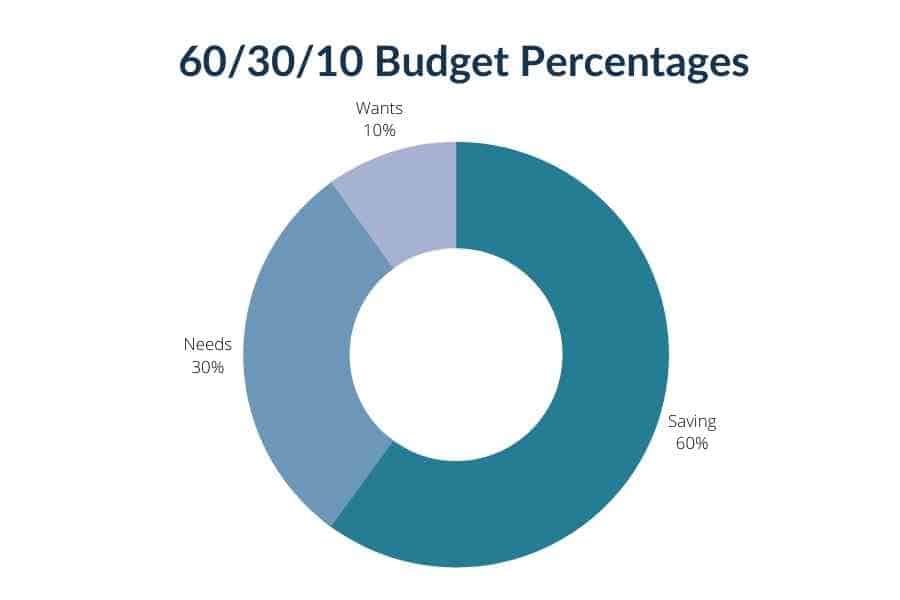

What is the 60 30 10 budget rule?

The 60 30 10 budget rule is designed for super savers. With this budget method, your income is divided like this:

- 60% for saving and investing

- 30% for expenses

- 10% for fun or wants

This budgeting method heavily emphasizes saving a big chunk of your income. You might consider this budget system if you’re interested in FIRE–financial independence, retire early.

You still get to spend 10% of your income on fun, just like with the 30 30 30 10 rule for money.

So, is saving 60% of your income realistic?

Not for everyone.

It is for me since I have no debt, other than my mortgage, and I’ve worked hard to grow my income over the years. But I know that’s not everyone’s situation.

If you can save that much, however, you could easily get on the fast track to building serious wealth!

Want to know more about how this budget method works?

Here’s a detailed review of the 60 30 10 budget rule.

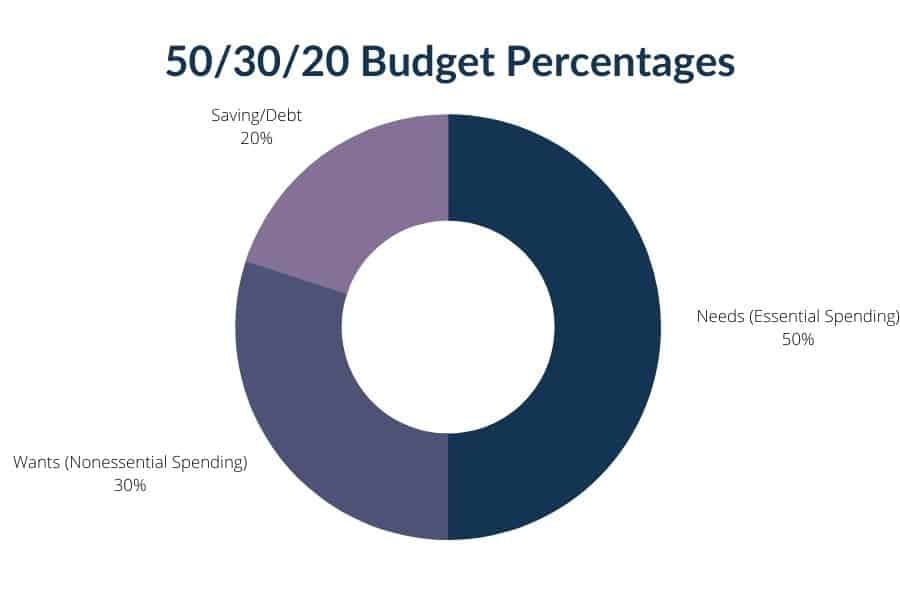

What is the 50-30-20 budget?

The 50-30-20 budget is arguably one of the most popular ways to budget by percentages.

Developed by Senator Elizabeth Warren, this budget rule suggests budgeting:

- 50% of your income for needs

- 30% of your income for wants

- 20% of your income for savings

Essentially, you’re spending 80% of what you make with this budget method and saving 20%.

The 50% for needs can include things like housing, food, utilities and debt repayment. The 30% for wants can include “fun” spending and anything that’s not considered essential.

The rest goes to savings. Super simple.

You won’t save as much with this budget rule as you would with 30-30-30-10 budgeting, the 70 20 10 rule budget or the 60 30 10 budget.

But you may consider it if you don’t have debt to repay and you’re comfortable saving 20% of what you make.

Here’s how to make a 50 30 20 budget and save more money.

Final thoughts on 30-30-30-10 budgeting

The 30 30 30 10 budget rule could work for you if you want a budget method that allows you to pay your bills and still have a life (without feeling guilty about it).

You can save with this budget method and pay down debt, plus have money left over for fun.

And it’s not difficult to try a 30-30-30-10 budget, even if you’ve never budgeted by percentages before. You just need to know:

- How much you make

- How much you spend

- What your money goals are

If you’ve struggled with other ways to budget, you may want to give this method a shot.

Have you tried the 30 30 30 10 rule budget? If so, head to the comments and tell me about it.

Don’t forget to grab your FREE monthly budget template in the Resource Library.

And be sure to take a peek at my favorite Smart Money Tools for making and saving money!