Last Updated on October 5, 2022 by Rebecca Lake

70 20 10 Budget Rule

Making a budget is one of the first steps you can take toward financial freedom. If you want a simple way to manage your money each month, you might try the 70/20/10 budget.

Never heard of it? Let me explain.

The 70 20 10 rule for money is one way to budget by percentages.

This budgeting system makes it easy to create budget categories or buckets that you add money to each month. It just requires doing some simple math.

If you’ve struggled with budgeting or how to cut drastically expenses, then switching to the 70:20:10 rule could solve a lot of your money headaches.

This article explains how the 70/20/10 budget works and how to use it to spend, save and invest for the future.

Related post: How to Make a Budget When You Hate the Idea of Budgeting

What Is the 70 20 10 Rule Money?

Again, the 70:20:10 rule is a really simple way to create a monthly budget.

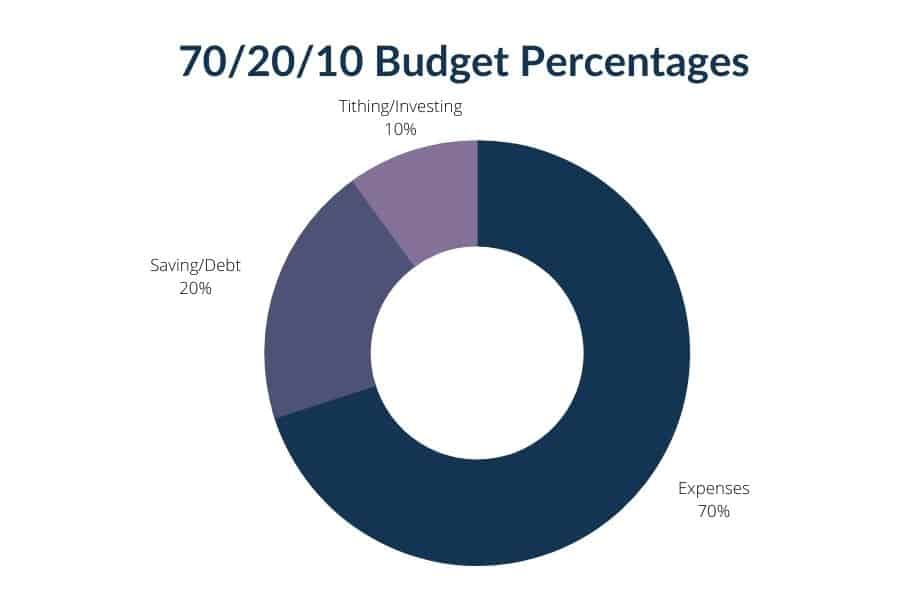

With this budgeting method, you’re creating a budget by percentages. Specifically, you’re breaking your budget down into three areas:

- 70% for expenses (i.e. everything you spend money on)

- 20% for saving (or debt, if you have debts you’re trying to pay off)

- 10% for tithing/investing/growing wealth

The 70 20 10 rule for money can work with any level of income and it’s flexible enough that you can adapt it to fit just about any pay schedule.

So for example, you could use the 70 20 10 rule to budget if you get paid biweekly or monthly. And it works for people who earn a regular paycheck or irregular income from side hustles or a business.

Related post: 30-30-30-10 Budget Explained (Pay Your Bills and Still Have Fun!)

How the 70/20/10 budget works

The beauty of the 70:20:10 rule for money is its simplicity. I guarantee that this is one of the least complicated budgeting methods you’ll ever come across.

Here’s how it works.

- Add up your monthly take-home pay (i.e. the money you get to keep after taxes and other payroll deductions)

- Divide that amount into three percentages: 70%, 20% and 10%

- Spend, save (or pay off debt) and invest using those percentages as a guide.

Here’s an example of the 70 20 10 budget rule in action.

Say your take-home pay is $5,000/month. If you can do some simple math, then here’s what you’ll get:

- 70% for spending = $3500

- 20% for saving (or debt) = $1000

- 10% for tithing/investing = $500

If that’s not an easy way to make a budget then I don’t know what it is. And when it comes to managing money, I’ll take easy over complicated every time.

Related post: Why Is Budgeting Important?

Why use a budget percentages breakdown?

There’s more than one way to create a budget and budget percentage methods are just one option.

For example, you could try the 60/30/10 rule budget.

There’s also the budget by paycheck method, the half payment method and zero-based budgeting.

All of them work differently but here’s the thing: they all require a little more effort than budgeting by percentages.

With zero-based budgeting, for example, you have to account for every single dollar of income down to the penny. The 70/20/10 budget rule doesn’t require you to do that.

Instead, all you have to do is figure out what your percentages are for each month, based on what you anticipate making.

Bottom line? The 70 20 10 rule for money can work for just about anyone, whether you’re making $1000 a month or $10000 a month.

Related post: How to Teach Budgeting to Kids

How to Use the 70/20/10 Budget Rule

The 70:20:10 rule is not hard to follow. But it does require you to do a little groundwork first.

Step 1: Add up your monthly take-home pay

Before you can start dividing up your money into percentages, you need to know how much you actually have to work with.

So the first step in 70/20/10 budgeting is adding up your income.

This includes all the money you bring in each month from:

- Paychecks

- Side hustles

- Business income

- Child support

- Alimony

- Government benefits (including unemployment)

- Commissions, tips or bonuses

Ideally, you have the same amount of income to work with every month.

But if you freelance or do side gigs on top of a regular job, you might have some months that are higher than others. Or if you get paid biweekly then you may have the occasional three-paycheck month.

So here’s a simple fix: Figure out your average monthly take-home pay.

Again, take-home pay means all the money you get to keep after taxes, health insurance and other deductions.

To find the average, decide how many months of income you want to track. (I like 12 but you could use six months or even three instead.)

Add up your income for those months, then divide by the number of months you chose. And voila–you’ve got your average monthly take-home pay.

Step 2: Add up where your money goes

Remember, with the 70/20/10 budget you have three buckets that you’re divvying money up into:

- Expenses

- Saving/debt

- Tithing/investing

Expenses include everything you spend money on in a given month.

For example, that includes essentials like:

- Housing

- Utilities

- Food

- Transportation

- Insurance

But it can also include spending on clothes, entertainment, hobbies–anything else that might be considered a want vs. a need.

It’s really important that you remember to include every single expense you have at this step. Otherwise, your budget percentages might not work when it’s time to apply the 70 20 10 rule.

If you don’t know how much you’re spending, don’t fret. Sixty-five percent of Americans don’t have a clue what they spend each month, according to a Mint survey.

But again, there’s an easy fix. You can use a finance app to track your spending for you.

The one I use and recommend is Personal Capital.

Personal Capital lets you sync your bank accounts and credit card accounts to easily see what you spend each month all in one place. If you’re not using Personal Capital yet, it can be a lifesaver for figuring out what you spend.

Get started with Personal Capital now

Step 3: Divide up your income

Now that you know what you’re making each month and what you typically spend, it’s time to make your 70/20/10 budget.

Specifically, that means dividing up your income into each budget category.

Expenses (70%)

First, start with your expenses.

Again, if you’re using the 70 20 10 budget rule then your goal is to have your expenses be no more than 70% of your income.

And if you can spend less than 70% of what you make that’s even better! That means you’ll have more money to put toward the other two categories, saving and tithing/investing.

So look at your income. We can use the $5,000 example mentioned earlier here.

Seventy percent of that would be $3500. This is the maximum amount of money you could spend each month on both wants and needs.

If you’re tracking your spending you should have a pretty clear idea of where your money goes. And if some months are higher than others, you can use an average similar to the way you did with take-home pay.

Related post: 60+ Sinking Funds Categories That Can Help You Budget Better

Savings (20%)

Next up, you should be putting 20% of what you make into savings each month. This is the recommended amount for the 70:20:10 budget rule.

You might save more of your income if your expenses total less than 70% of your take-home pay. And that’s a great thing because the more you can save, the faster you can build wealth!

But what if you’ve got debt?

In that case, then you’d have to decide how much of this 20% should go to debt and how much should go to savings each month.

Whether to save or pay down debt can depend on your goals and how much your debt is costing you.

For example, if you could earn 0.50% in a savings account but paying a 15% APR on your debts, then getting rid of debt first could pay off more than saving.

But I’m all about balance and I also know how important it is to have something saved for emergencies.

So a solution is to split the difference and put some of your 20% to debt and some to savings. This way, you can create a financial cushion while still wiping out your debt.

And if you need a place to keep savings, consider CIT Bank.

CIT offers competitive rates for savers with minimal fees. You can set up automatic deposits every payday so you’re saving without having to think about it!

Get started with CIT Bank today

Tithing/investing (10%)

The last 10% of your 70/20/10 budget is dedicated to tithing and investing.

Tithing means giving part of your income to your church. If you don’t attend church regularly you could earmark money to your favorite charities instead.

After tithing, you’d use the rest of your 10% to invest or save toward other goals.

For example, you might want to open a taxable brokerage account to invest for retirement.

Investing money is riskier than saving but it’s pretty much essential for growing wealth. And when you use an online investment platform like M1 Finance, you can avoid high fees that might eat into your returns.

Or you might want to set aside money for your kids to help pay for college. So using some of your 10% to contribute to a 529 college savings plan could make sense.

Knowing what you want to do with this 10% matters for making the most of it. So if you haven’t given much thought to your big financial goals, now’s a great time to figure out what kind of money vision you want to create for yourself and your family.

70/20/10 Budget Isn’t Working: Now What?

So, what if you’ve added up your income but your expenses are more than 70% of what you make?

And believe me, it can happen if you live in an expensive city or you just don’t earn a lot of money.

When you’re trying to make the 70 20 10 budget work but it just isn’t happening, there are two things you can do:

- Cut your expenses

- Find ways to make more money

How to cut expenses

Lowering or eliminating your expenses can help you get to the 70% or below mark for budgeting.

So, first figure out how much you’re over by. This can help you decide how much you need to cut.

For example, if you’re spending 80% of your income then you’d need to cut expenses by 10%. If you’re spending 90% of what you make then you’d need to cut expenses by 20%.

You get the idea.

Hopefully, you’re pretty close to 70% already so that drastic cuts aren’t needed. Start with nonessentials first, then look at what you might be able to reduce with your fixed expenses.

Here are some simple ways to save money:

- Ditch your contract cellphone and switch to prepaid phone service

- Get rid of cable

- Raise your insurance deductibles to lower your premiums

- Start planning meals at home

- Cut out subscriptions you don’t need (I recommend Trim for this)

You can also try to negotiate with your billers to lower your expenses. And if you don’t have time for that, Truebill can do it for you.

Truebill is a bill negotiation service that helps you save money. When you sign up for Truebill, their experts look at your bills then work with your billers to help you get a better deal.

If you’re struggling with what to cut to get your spending to the 70% mark, Truebill can help.

Related post: 40 Ways to Cut Expenses and Stop Wasting Money

How to make more money

Making more money can also help you create a balanced 70/20/10 budget.

There are different ways to make extra money, including:

- Negotiating a raise

- Getting a part-time job

- Working more hours

- Starting a side hustle

Out of all those options, I’m partial to side hustles.

There are so many ways to make money on the side, including plenty of ideas for making money at home.

For example, some of the best paying side hustles include:

- Getting paid to type

- Online proofreading jobs

- Becoming a virtual assistant

- Freelance writing

- Blogging

- Joining online research studies

- Becoming an online stylist

Then there are easy ways to make money, like taking surveys or using cashback apps when you shop.

Between Survey Junkie and the Ibotta app, I’ve made close to $3,000 so I know these are real side hustles that pay.

So if you need to make extra money, consider what money-making skills you might already have. And don’t forget about other easy ways to get free money!

Related post: 50 Free Money Hacks to Get Cash Now

70-20-10 vs. 50/30/20 Budgeting Method

The 70/20/10 rule isn’t the only way to budget by percentages. You could also try the 50/30/20 budget.

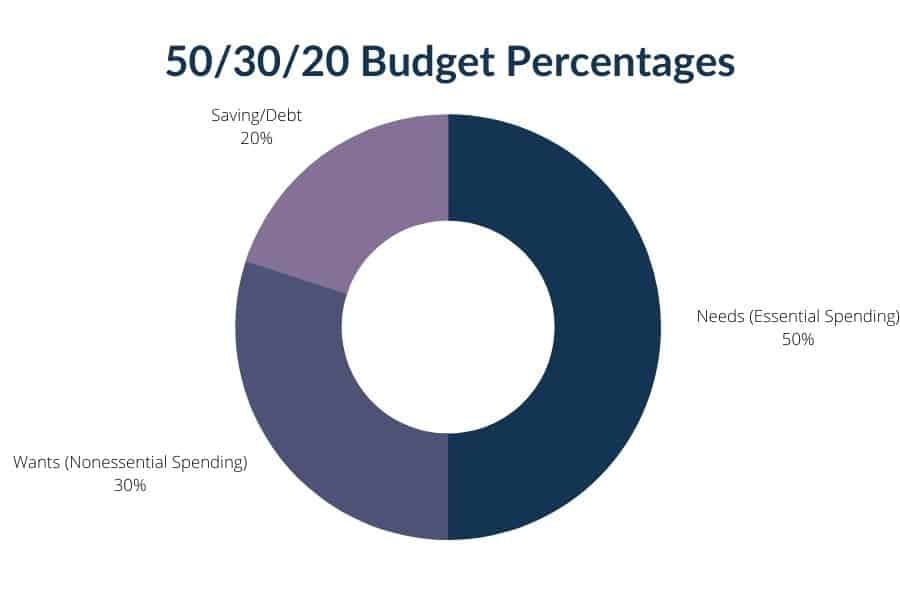

This one still uses percentages but they work a little differently. Here’s what your spending looks like:

- 50% for needs

- 30% for wants

- 20% for savings

Compared to the 70 20 10 rule, the 50-30-20 method gives you 80% of your income to spend. But that 80% has to be divided up between needs and wants and it has to cover everything you spend in a month.

You’re still saving 20% of your income with the 50/30/20 budget. But this budgeting system doesn’t specifically require you to allocate another 10% to investing or tithing.

In terms of whether the 70:20:10 vs 50/30/20 method is better, it really depends on how you like to think about your money.

If you want to just group all your spending together, then have the rest for saving or investing you can do that with the 70 percent budget.

On the other hand, if you want to distinguish between how much goes to needs and how much goes to wants, then you’re probably better off with the 50 30 20 rule or the 50 15 5 rule instead.

Of course, you can always try making a budget both ways to see which one works best for your financial situation.

Here’s more on how the 50 30 20 budget works and how to use the 50/30/20 rule to budget.

Final thoughts on 70/20/10 budget system

Using a budget percentage breakdown can take the stress out of budgeting. And the 70:20:10 rule for money is super simple to follow.

You just need to know some basic math to figure out how to create a budget using the 70 percent rule.

The challenge, as with any budget, is committing to sticking to it.

But if you can do that, you’re practically guaranteed to see your finances improve. Whether that means getting out of debt, beefing up your savings or just worrying about money less, those are all things you can achieve with the 70:20:10 budget.

Got a budgeting tip to share? Head to the comments and tell me about it!