Last Updated on October 8, 2022 by Rebecca Lake

Household Budget Percentages: How Much Should You Be Spending?

If you’re new to budgeting or you’re looking for a better way to manage your money, the budget percentages method could be a great fit.

When you budget by percentages, you’re assigning a specific percent of your income to different spending categories. It’s a simple way to divvy up the money you earn each month.

There are different ways to create a percentage budget plan, including the:

- 50/30/20 budgeting method

- 70/20/10 rule

- Dave Ramsey budgeting percentages

- 30-30-30 budget

- 60/30/10 rule budget

- 50 15 5 rule

Understanding how a percentage budget plan works can help you decide if it’s right for you.

Related post: 15 Simple Ways to Save Money on a Tight Budget

Budget Percentages: What Does It Mean?

The spending percentages method isn’t complicated. It just means dividing up your income by percentages each month, then assigning each of those amounts a specific job.

It’s a simplified way to create your ideal budget, based on what you earn.

Calculating monthly expenses as a percentage of income means you don’t necessarily have to track every single dollar the way you would with something like zero-based budgeting.

With a zero-based budget, every dollar of your money is given a specific job. The goal is to have zero money left over.

When you budget by percentages, you can create “buckets” for spending instead.

As you get paid each month, you fill the buckets up. Then as you spend or pay bills, you take money back out of those buckets.

Related post: Why Is Budgeting Important?

How do you find the percentage of a budget?

Finding the percentage of a budget is actually pretty easy. It just involves some quick math.

To find the percentage of a budget, you need to know:

- The total amount of money you’re budgeting

- The value of a specific budget category or expense

So, say you want to know what percentage of your budget you spend on housing. Your monthly budget adds up to $4,000 and your mortgage payment is $1,000.

To find the percent spent on housing, you’d use divide your mortgage payment by your total budget amount, then multiply by 100.

So it would look like this: $1,000/$4,000 = .25 x 100 = 25%

Pretty easy, right? That’s why using budget percentages is so great–anyone can do it with this simple formula!

What do average household budget percentages look like?

The Bureau of Labor Statistics compiles information on how U.S. households spend their money. So I thought it would be helpful to see how much the typical household makes and spends in a year to see how it compares to your household.

Here’s how consumer spending adds up, according to the Bureau of Labor of Statistics:

- Average income before taxes: $82,852

- Average annual expenditures: $63,036

- Food, including food at home and away from home: $8,169

- Housing: $20,679

- Apparel and services: $1,883

- Transportation: $10,742

- Healthcare: $,5193

- Entertainment: $3,050

- Personal care products and services: $786

- Education: $1,443

- Cash contributions: $1,995

- Personal insurance and pensions: $7,165

- All other expenses: $1,891

Not surprisingly, housing represents the biggest budget percentage. If you look at the average spending on housing compared to the total amount spent on average, it represents 32% of the typical household budget.

You’ll notice this budget percentage breakdown doesn’t include savings specifically, though it’s mentioned in part with pensions.

The personal savings rate, or how much the average household is saving at any given time, varies and it often depends on what’s happening with the economy.

For example, in April 2020 people the savings rate spiked at 33% of income, according to the Federal Reserve. Which makes sense as that’s when lockdowns were beginning and people were staying home more often.

But if you go back to April 2008, people were saving just 3.4% of their income as the economy bottomed out and jobs were being lost.

So what do all these numbers mean for you?

Simply, that you can use them as a guideline for creating your ideal budget.

Related post: 12 Best Budget Planners to Organize Your Finances

Common Budget Percentage Methods

As mentioned, there’s more than one way to budget by percentages. And that’s a good thing because you can test different strategies out to find your ideal budget percentage.

If you’re curious about what a budget percentage breakdown should look like, here’s how three popular options work.

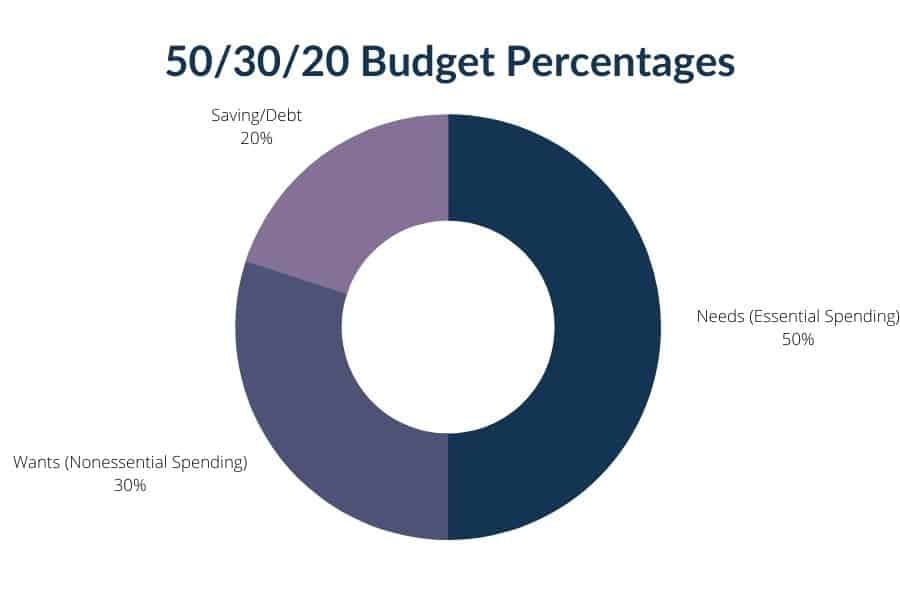

50/30/20 budget method

The 50/30/20 budget method, also called the 50/30/20 budget rule, requires you to divide monthly expenses as a percentage of income like this:

- 50% for essential expenses/needs

- 30% for nonessential expenses/wants

- 20% for saving

So here’s a 50/30/20 budget method example.

Say you take home $5,000 a month after taxes. Using the 50/30/20 rule, you’d allocate:

- $2500 of that toward essential expenses or needs

- $1500 toward nonessential spending or wants

- $1000 to savings

This budget percentages method is straightforward and easy to calculate. You don’t have to break each percentage down into individual spending categories unless you really want to.

The key to making the 50/30/20 budget rule work for you is knowing the difference between needs and wants, and prioritizing savings.

So, for example, needs including things like housing, utilities, food, insurance and necessary transportation costs so you can go to work, take the kids to school or run errands.

Wants are anything you spend money on that you could technically live without. That means things like new clothes, entertainment, recreation, hobbies–you get the idea.

Finally, savings can mean putting money into an emergency fund, saving for retirement, investing to grow wealth or funding a 529 account for college. You could also include sinking funds under the savings category as well if you have irregular expenses you need to save for.

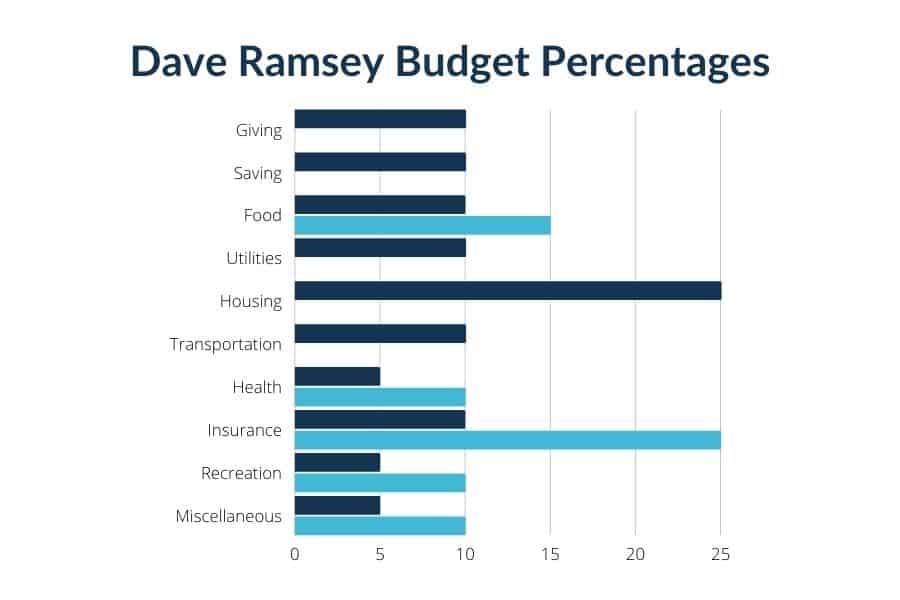

Dave Ramsey budget percentages

Dave Ramsey is a personal finance guru who’s helped millions of people pay off debt, save money and live better. He’s probably best known for his baby steps method of paying off debt.

(And if you haven’t read The Total Money Makeover yet, check it out. His strategies helped me pay off almost $100K in debt and save nearly $1 million!)

But he’s also developed the Dave Ramsey budget percentages system for paying monthly expenses using percentages of income.

Here’s what the Dave Ramsey budget percentage breakdown looks like:

- Giving – 10%

- Saving – 10%

- Food – 10 to 15%

- Utilities – 5 to 10%

- Housing – 25%

- Transportation – 10%

- Health – 5 to 10%

- Insurance – 10 to 25%

- Recreation – 5 to 10%

- Personal Spending – 5 to 10%

- Miscellaneous – 5 to 10%

Compared to the 50/30/20 budget method, the Dave Ramsey budget percentages are a bit more involved. Which is to say, there are more categories you have to assign money to each month.

But the idea is still the same: take your income and split it up into percentages for each category.

So let’s try a Dave Ramsey budget percentage example since we did one for the 50/30/20 budget rule.

Again, assume your monthly income is $5,000 after taxes. Here’s what your budget percentage breakdown would look like if you stick to Dave Ramsey’s plan:

- Giving – $500

- Saving – $500

- Food – $500 to $750

- Utilities – $250 to $500

- Housing – $1250

- Transportation – $500

- Health – $250 to $500

- Insurance – $500 to $1250

- Recreation – $250 to $500

- Personal Spending – $250 to $500

- Miscellaneous – $250 to $500

As you can see, you still have some flexibility with this budgeting method.

While some of the categories have fixed recommended budget percentage amounts, others give you a range that you can adapt to your individual spending habits or needs.

The biggest difference between Dave Ramsey’s budget percentages and the 50/30/20 budget rule is that saving only gets 10% instead of 20%. Of course, you can always tweak the percentages to fit your ideal budget if you’d rather earmark more of what you earn to saving.

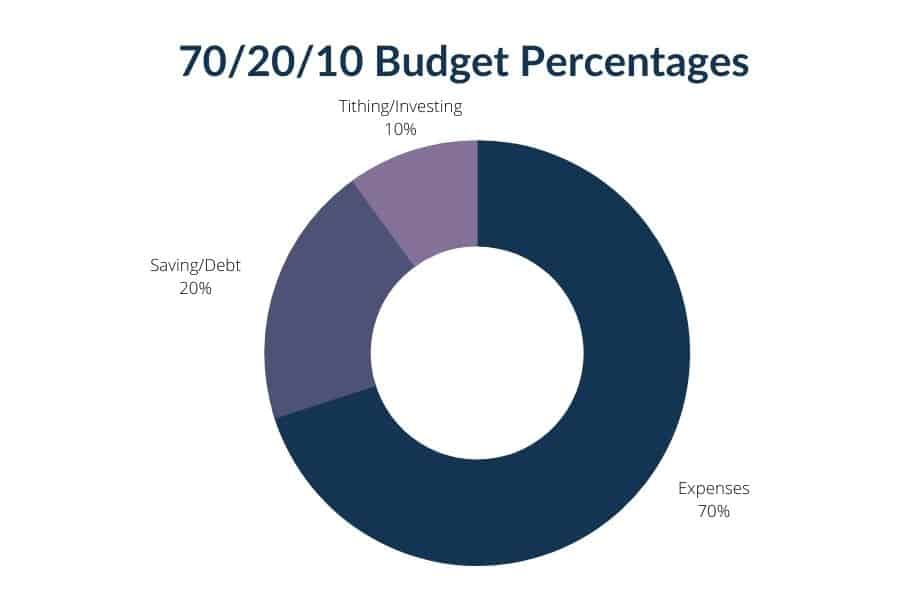

70/20/10 budget method

The 70/20/10 budget rule offers a different spin on the 50/30/20 rule.

With this method, your budget percentage breakdown would look like this:

- 70% to expenses

- 20% to savings and debt

- 10% to giving and investing

Compared to the 50/30/20 budget rule or Dave Ramsey budget percentages, the 70/20/10 rule doesn’t distinguish between wants and needs.

All monthly expenses for percentage of household income get lumped into the 70% bucket. So for example, you’d use that one bucket to account for:

- Rent or mortgage payments

- Utilities

- Cellphone service

- Food

- Insurance

- Gas and transportation

- Recreation and hobbies

- Personal care

- Travel

Then you’d use the 20% bucket for savings and debt, followed by the 10% bucket for giving and investing.

But what if you have a lot of debt? Should you use all of your 20% bucket for that?

Depending on which financial expert you’re asking, some would say focus on the debt first.

In fact, that’s what Dave Ramsey advocates in The Total Money Makeover. He recommends saving $1000 for emergencies, then using the debt snowball method to pay off all your debts before saving or investing anything else.

But as 2020 taught us, there’s definitely a need to have emergency savings in case you lose your job.

Ultimately, you have to decide what’s more important to you and what can help you sleep better at night.

If that means putting 5% to savings and 15% to debt, then so be it. Or if you’re more comfortable with a 50/50 split so you can build savings faster then go with that.

The goal with the percentage budget plan is to find the ideal budget for you, not anyone else.

Which Budget Percentage Method Is Best?

I’ve given you three ways to divvy up your household budget by percentages. So which one is the best?

The truth is, there’s no right or wrong answer because everyone budgets differently and everyone has different needs when it comes to their money.

But if you’re stuck on which one to choose, here’s a recap of how they work:

50/30/20 budget rule pros:

- Easy to calculate, since there are only three percentage categories

- Prioritizes saving more of your income compared to other budget percentage methods

- Doesn’t require you to track every single dollar

50/30/20 budget rule cons:

- May not work as well if you have higher housing costs

- It could be easy to blur the line between wants and needs

Consider the 50/30/20 budget rule if:

You want the simplest way to budget by percentages while dedicating more of your money to savings.

Dave Ramsey budget percentages pros:

- Allows for a more detailed budget percentage breakdown

- Includes a budget category for tithing/giving

- Leaves room in your budget for miscellaneous spending

Dave Ramsey budget percentages cons:

- Assumes that you’ve already paid off all your debt

- Allocates a smaller percentage of income to savings

Consider Dave Ramsey budget percentages if:

You’ve paid off all or most of your debt and want a more detailed budget percentage breakdown to follow each month.

70/20/10 budget rule pros:

- Uncomplicated way to budget by percentages

- Includes percentages for saving and investing, which can help with growing wealth

- No need to assign every dollar a specific job

70/20/10 budget rule cons:

- Lower allocation to investing and giving

- Grouping all expenses together could make it harder to find budget leaks

Consider the 70/20/10 budget rule if:

You’re comfortable having all of your expenses in a single budget, without having to distinguish between wants and needs for budgeting purposes.

Budget Percentages Calculator

Using a personal budget percentage system isn’t complicated. It just involves doing some simple math.

But it’s always helpful to have a tool that can do it for you.

So if you’re looking for some budgeting percentages calculators, here are a few you can try:

- 50-30-20 rule budget calculator

- Budget Breakdown Calculator (this one uses Dave Ramsey budget percentages)

- Budget Percentages Calculator (this one lets you create custom budget percentage categories)

Remember, these budget percentage rules are meant to be guidelines for how to create your budget.

So you may need to experiment with different calculators and budget methods to find one that works best for you.

How to Create a Monthly Budget (and Stick to It)

Making a budget, whether you use percentages or not, often seems more complicated than it really is.

Ultimately, making a budget comes down to:

- Choosing a budgeting method

- Knowing what you make

- Knowing what you spend

This guide to budget percentage methods can help you figure out if it’s right for you. And remember, there are other ways to budget as well, like the budget by paycheck method.

Once you choose a budgeting method, the next step is knowing what you make. This means adding up all your income each month from:

- Paychecks

- Side hustles

- Investments

- Government benefits (i.e. unemployment)

From there, you can work on adding up everything you spend. Again, this is where it helps to sort out wants from needs.

If you’re having trouble figuring out where your money goes, then try using a free tool like Personal Capital to track your spending.

Personal Capital links up to your bank accounts and credit card accounts to automatically record where you’re spending money. Tracking your spending regularly can help with actually sticking to the budget percentage rules you set for yourself.

Related post: 12 Best Budgeting Planners to Organize Your Finances

Final thoughts on how to budget by percentage of income

Making a budget really can change your financial life.

Living on a budget has helped me pay off all my debt, aside from my mortgage, while saving for emergencies, retirement and my kids’ future college costs. And if I can do that as a single mom with no other financial help then I really think it’s possible for anyone to make budgeting work.

Do you have a favorite budgeting method?

Head to the comments and tell me about it. And don’t forget to grab your free budget template!

Read more posts on how to budget:

- 17 Dave Ramsey Tips That Can Make You Rich

- 9 Budgeting Mistakes That Are Costing You Money

- 60+ Sinking Funds Categories to Help You Build a Better Budget