Last Updated on September 1, 2024 by Rebecca Lake

You know you need a budget to stay on top of your money. But do you know how to avoid expensive budgeting mistakes?

It takes time to get into a budgeting habit and it’s important to know what NOT to do when managing spending and income. Today, I’m sharing some potentially costly budgeting mistakes that are best avoided when you’re trying to get ahead financially.

Want Free Money?

Check out my favorite apps for earning cash fast!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions. Get paid to answer questions in your spare time!

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid for your opinion. An easy way to earn extra cash!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

Table of Contents

What Is a Budget?

A budget is a plan for spending money each month. On one side you have your income; on the other, your expenses.

Why do you need a budget? That’s the better question and here’s the simplest answer. Having a budget puts you in control of your money.

When you commit to budgeting every month you decide where your money goes. You might have a lot of income to work with or a little. Regardless, a budget can help you make the most of every penny.

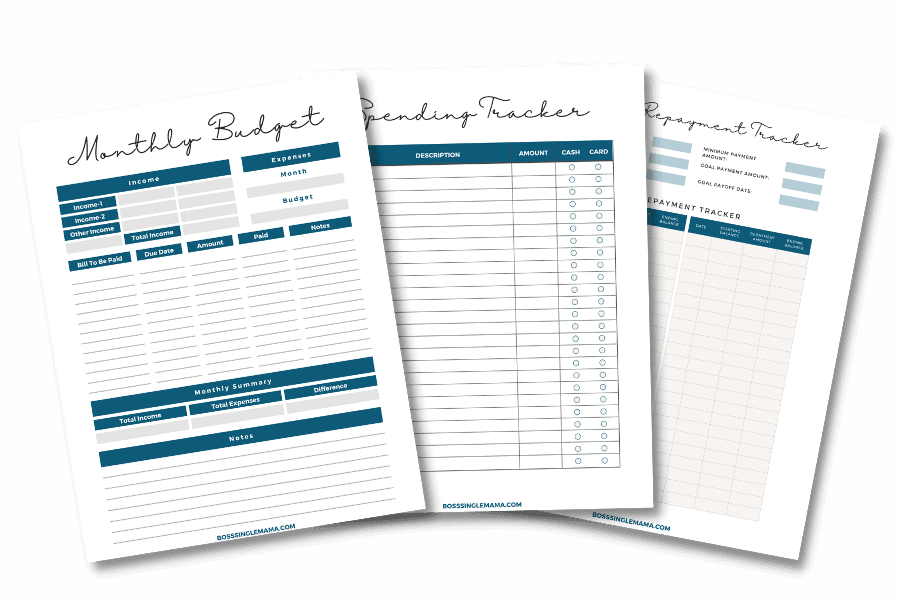

Get Your Budget on Track

Grab these free printable budget templates to take control of your money!

9 Budgeting Mistakes That Everyone Should Avoid

If your budget isn’t working or you find it hard to stick to it, it helps to understand why. There are a lot of things that could cause a budget to fail, including the budgeting mistakes I’m about to share with you.

(Confession time: #2, 3, and 5 used to totally kill my budget.)

As you go through the list, ask yourself if you’re making any of these budget mistakes. Then, learn what you can do to fix your budget and get back on track.

Mistake #1: Thinking you don’t need a budget

Assuming you don’t need a budget can lead to trouble if you’re overspending, are in debt, or just have no idea how much things really cost.

You might think that as long as the bills are paid and you’ve got money in your bank account a budget is irrelevant. But that’s a mistake because it can lead you to under-utilize the money that you have.

For example, you might have an extra $500 that just sits in your bank account instead. Meanwhile, you have nothing in savings or you’ve got credit card balances that never seem to go down.

If you had a budget in place, then you’d give those extra dollars a job. It might be growing savings or paying down debt, but whatever it is you’re not just sitting on idle cash.

How to fix it: Learn what budgeting can do for you

The importance of budgeting can’t be underestimated and if you don’t understand the benefits, it’s time for a crash course.

There are lots of great resources that can help you better understand what a budget is designed to help you do. You might start with this guide on how to make a budget.

As you learn, you can also teach kids about budgeting to help them learn good money habits from an early age.

Mistake #2: Failing to track expenses

Making a budget is a pretty straightforward process.

You add up your expenses for the month, then subtract that amount from your income. It seems simple, right?

Where you can run into problems is not tracking your spending.

Sure, you might know what your rent or mortgage payment is or how much your light bill is on average, but do you know to the penny what you’re spending on groceries or your kids’ activities or clothes each month?

If the answer is no, you can almost guarantee that your budget’s going to backfire.

How to fix it: Use a budgeting app to track your spending

Budgeting apps make it so much easier to manage spending. You just link up your bank and credit card accounts and the app does the hard work for you.

You can see at a glance where all your money goes each month. Some expense-tracking apps go a step further and allow you to categorize spending using tags.

That’s helpful if you have multiple budgeting categories to track.

For a long time, Mint was my go-to budgeting app. Since Mint shut down I’ve moved over to Empower (formerly Personal Capital).

Empower is great because you can see everything from your dashboard. You can also link investment accounts to track your net worth or invest with Empower if you’re ready to work on some big financial goals.

Looking for a simple money management tool? Empower makes it easy to track spending, saving, investing, and budgeting in one place so you can tackle your financial goals!

Mistake #3: Letting money slip through the cracks

One of the worst budgeting mistakes you can make is throwing money away without realizing it.

You might assume that it’s the big expenses that wreck your budget but it’s not. It’s those small costs that end up overlooked that can take the biggest bite out of your spending.

Bank fees, for example, can quickly add up. The typical American pays $288 a year in bank fees on average.

That’s crazy, right? Think of what you could do with an extra $3,600 each year!

Aside from bank fees, there are other things like streaming services, subscriptions, and recurring fees that you forget about. It’s all money that’s going down the tubes you can and should reclaim.

How to fix it: Plug the money leaks

If you’re tracking your spending, then it’s time for a total budget review. Start with the basics first.

How much are you budgeting towards essentials, like housing, utilities, and groceries each month?

Next, how much are you budgeting for everything else?

Now, compare what you’re budgeting for each expense to what you’re actually spending. Are there things you’re spending more (or less) on than you budgeted for?

Review every single expense in each budget category and ask yourself, “Can I cut back on this or get rid of it altogether?”

It might seem a little tedious but it’s a must if you’re going to fix your budget and smooth out your spending.

Mistake #4: Not budgeting for savings

Saving can be a challenge when there’s only so much money in your budget to go around. But it’s a mistake to skip out on savings altogether.

Let’s say you have an unexpected expense come out of nowhere. If you don’t have an emergency fund to rely on, you might have to use a high-interest credit card to fill the gap.

Building savings into your budget can help you avoid expensive debt. And chances are you’ll sleep a little better at night knowing that you have a cash cushion you can draw from if you need to.

How to fix it: Add savings to your budget

If you’re not naturally a saver, it can be hard to get started. I personally love to save money now but it wasn’t always that way.

An easy fix to start a savings habit is to treat it as an expense in your budget.

It doesn’t matter if you start small either. Thinking small is a good thing because it makes saving seem a lot less overwhelming. Even if you can only find $10 a month to save, that’s something.

Most importantly, commit to saving it every single month.

Automating transfers from checking to a separate savings account is the easiest way to do that. You can open a high-yield savings account and set up a recurring transfer every payday.

If you’re not sure where to open a savings account, check out Raisin.

Raisin partners with banks to offer high-yield savings accounts and CDs that you can open with just $1. There are no fees and the savings account rates are some of the best you’ll find online.

Looking for the best high yield savings option? Compare savings account rates online at top banks and credit unions now!

Mistake #5: Not saying no

Budgeting is about drawing lines in the sand. You look at your income and say, “Okay, I’m going to spend XYZ on this,” and that’s it.

In theory, that should be easy to do. But if you’re terrible at saying no to your kids, yourself, or anyone else, your budget’s never going to work.

How do I know?

Because I’m guilty of spending money on things that I didn’t budget for because I couldn’t say no. And every single time, I had instant regret.

But eventually, I realized that I was blowing my budget for no good reason and committed to changing it.

How to fix it: Set spending rules

The next time you’re tempted to spend money impulsively, try this instead. Give yourself a cooling-off period to think about the purchase and decide if it’s worth spending the money.

For example, you might follow the 48-hour rule and require yourself to wait two days before following through on a purchase. Or you might try a longer 30-day window instead for larger purchases.

These rules don’t mean you can’t follow through on the purchase. They just help you to slow down and think about whether spending the money makes sense, especially if it requires you to draw money from another part of your budget to make it work.

Mistake #6: Budgeting without goals

You might make a budget every month but do you know why you do it?

One of the biggest misconceptions about budgeting is that it means you have to shut down your spending and deprive yourself of anything fun.

Not true.

A budget isn’t about what you can’t do; it’s about what you can do when you’re in charge of your money.

Ask yourself what your goal is for budgeting.

Is it because you’ve gotten into debt from overspending and you want to break the cycle? Or because you’re finally ready to start saving?

You need to know why you’re budgeting and what you’re working towards; otherwise, it’s just a wasted effort.

How to fix it: Become a money goal-setter

What are your money goals? Think about what you want your financial life to look like.

- Where do you live?

- How much money do you make?

- What kind of work are you doing?

- How much money do you have in the bank?

- What kind of feelings does your money situation inspire?

Your money vision can inspire some financial goals. For instance, your goals might include:

- Saving $1,000 for a starter emergency fund

- Paying down $10,000 in credit card debt

- Opening an IRA and saving $500 a month for retirement

- Contributing money to a college savings fund for your kids

- Starting a business so you can leave the 9 to 5 life behind

Pick one thing you want to work on, then ask yourself what steps you need to take to reach that goal. Look at your budget to understand how realistic each step is and how long it will take you to complete each one.

Mistake #7: Using the wrong budget method

There are lots of ways to make a budget.

How you choose to do it might be completely different from how your best friend or your sister does it.

For example, some of the ways to budget include:

The struggle happens when you’re using a budgeting system that doesn’t fit you.

It just makes you more frustrated and the more frustrated you get, the more tempted you might be to just walk away from budgeting altogether.

How to fix it: Find the right budgeting tools

There’s no end of tools out there to help you plan your budget. You just have to find the one you like best.

For instance, you can try budgeting apps, budgeting software programs, or spreadsheets.

You can use the half-payment method to budget, the cash envelope system, or a zero-based budget.

There are so many different options and ways to fix your budgeting mistakes.

I recommend trying out a few different things to see what clicks. Give it at least a month for each budget system you try on.

The worst that can happen is that at the end of the month, you move on to something else until you find “The One”.

Bottom line, budgeting should help you stress less about your money, not more. It doesn’t matter which system you choose. All that matters is that it works for you.

Get Your Budget on Track

Grab these free printable budget templates to take control of your money!

Mistake #8: Skipping budget reviews

Your budget isn’t something you should just set and forget. Your budget should change as your life changes.

For example, if you get a raise at work but you don’t update your budget, chances are any extra money you’re making is just going to get spent. The same goes if you pay off a debt or some of your expenses go down.

Your budget has to fit where you are right now financially, not where you were six months or a year ago.

How to fix it: Schedule budget dates

Maintaining a good relationship with your money is the same as maintaining any other relationship. You have to put in the time and effort to make it work.

That’s where budget dates come in.

You block off a chunk of time regularly to look at your income and spending. This is when you can make any adjustments if you see your budget veering off-course.

Plan to sit down with your budget at least once a month; once a week might be even better if you have the time, especially if you’re trying to make a budgeting comeback.

The key is to be consistent with the timing and commit to showing up.

Mistake #9: Not sticking to your budget

When you’re living on one income or your money just doesn’t seem to ever stretch, it’s tempting to just give up on budgeting altogether.

But that might be the costliest of the budgeting mistakes you can make.

When you assume that budgeting just doesn’t work for you, you’re not giving yourself a chance to manage your money any differently. And that can keep you stuck in debt, with no savings, wasting money every month.

Not exactly where you want to be, right? But that doesn’t have to be your reality.

How to fix it: Adjust your money mindset

If you struggle to stay on track with your budget you’ll need to reframe how you think about it.

Don’t focus on what you don’t have or the budgeting mistakes in your past. Look at where you want your money habits to take you going forward.

Stay focused on what you can do to make your budget better, instead of wallowing in where you went wrong.

Any time you feel like giving up or giving in to an overspending urge, remind yourself that your budget has a purpose and it’s to help you live a financially stress-free life.

Final Thoughts: Don’t Let Budgeting Mistakes Cost You

Getting budgeting wrong can hurt you in more ways than one but if you’re making any of these mistakes, know that you can turn it all around. After all, no one is perfect and what matters most is that you’re showing up regularly and making the effort to take charge of your finances.

Need more budgeting tips? Read these posts next: