Life doesn’t always go smoothly and when something unexpected happens it can turn up the pressure financially. Knowing how to approach budgeting in a crisis can make it easier to get through the situation you’re facing.

Today I’m sharing some helpful tips for managing your money when life throws an unexpected curve ball your way.

Want Free Money?

Check out my favorite apps for earning cash fast!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions. Get paid to answer questions in your spare time!

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid for your opinion. An easy way to earn extra cash!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

Budgeting in a Crisis: 5 Tips to Manage Your Money

There are lots of situations that could lead to a financial crisis. You might experience a job loss, for example, or be unable to work because of an illness or injury. More extreme situations can involve the loss of a home due to fire or natural disaster or the loss of a spouse.

When a crisis happens, your finances may be the last thing on your mind. But at some point, you’ll need to think about what’s happening with your money. These tips are designed to help you stay afloat until your situation stabilizes.

1. Create an emergency budget

An emergency budget is a temporary spending plan that includes your most essential expenses. You can think of it as a downsized version of your regular monthly budget.

If you’re budgeting in a crisis because of a significant drop in income, then it’s important to get your expenses as low as possible. The main goal is to make sure you’re budgeting to:

- Keep a roof over your head

- Make sure the lights and water stay on

- Feed your family

- Maintain insurance to protect your property and health

Those are the most basic needs your budget should help you meet and the expenses you should be planning for first.

Now, look at everything else you spend money on each month that isn’t a basic need. Go through your expenses one by one to see what can cut back on or get rid of.

The most obvious choices for cutting spending include:

- Subscription services you don’t use

- Eating out (or getting food delivered)

- Entertainment

- Travel

- New clothes

- Cable TV

- Pricey cell phone plans

- Hobbies and recreation

- Electronics and gadgets

- Toys for the kids

- Books and magazines

You may need to be a little ruthless here but every penny you can add back into your budget counts. And remember that you can always adjust your spending later once the crisis has passed.

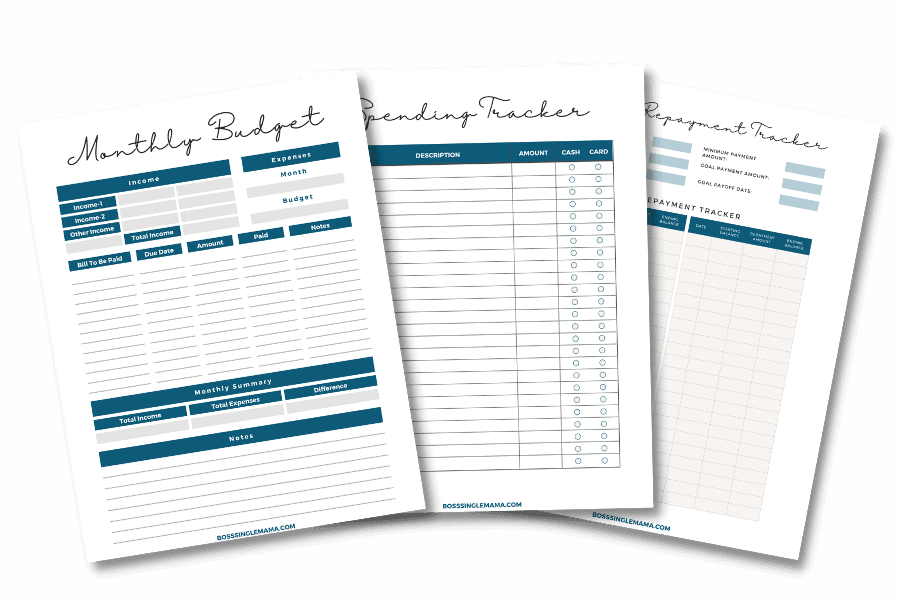

Get Your Budget on Track

Grab these free printable budget templates to take control of your money!

2. Figure out how much money you have to budget

Budgeting in a crisis often means that you have less income to work with.

If you lose your job or your hours get cut, for example, that’s less money coming in. So you have to adjust your budget accordingly.

Here’s a good rule of thumb for coming up with a baseline amount you can afford to budget each month if your income has dropped. Cut your spending by the same percentage.

So if you’re making 30% less right now because of a financial emergency or crisis, then you’ll need to cut spending by at least 30% to keep pace.

I know that sounds like no fun at all and it isn’t. But if you don’t want to end up going into debt with credit cards or loans then you’ll have to adjust your spending to fit what you’re making.

Also, don’t forget about savings and things you can do to make money during a crisis.

Ideally, you have a decent emergency fund waiting in the wings you can draw on; more than half of Americans have something set aside for rainy days. But if you’re not one of them you might have some things lying around the house you could sell for cash that you could stash in savings.

Looking for the best high yield savings option? Compare savings account rates online at top banks and credit unions now!

3. Suspend automatic payments and savings

As you review your budget it’s important to prioritize and look at what you can cut. The goal is to make your budget as lean as possible while in crisis mode.

Canceling automatic payments can help you avoid overdrafts in your bank account if you don’t have the money on hand to pay a bill when it comes due. You could also temporarily halt any deposits to savings, including automatic transfers and retirement plan contributions.

Doing these things is not ideal but it may be necessary if you need to keep a tight grip on exactly where your money is going.

If you think you won’t be able to pay a bill on time after canceling your automatic payment, call your biller and let them know. They may be willing to work with you on moving up the due date or waiving late fees if you give them a heads-up.

Remember to reinstate your automatic payments and savings deposits later once your financial situation settles down. If your budget allows it, you might consider temporarily increasing your savings deposits if you took money from your emergency fund to pay bills during the crisis.

4. Talk to your creditors

Budgeting in a crisis when you have debt means you need to be proactive about managing it. Otherwise, you could set yourself up for financial headaches if you fall behind on payments.

Making a simple phone call to your creditors can help you stay in control. For example, if you have credit card debt you may be able to qualify for a hardship program. Your credit card company may temporarily pause payments, lower your interest rate, or waive certain fees.

If you have federal student loans you might qualify for a deferment or forbearance to take a break from making payments. Private student lenders may offer similar debt relief options.

Either one could help reduce your monthly payments so budgeting your money is easier. And you can also reach out to your lenders to see what other options exist if your budget is so tight you can’t make your payments.

Other ways you might be able to negotiate include:

- Asking for a better deal on car insurance or homeowner’s insurance

- Reducing your cell phone or internet plan

- Asking your landlord for a better deal on rent if you don’t own a home yet

- Switching banks to avoid hefty fees

- Working out payment plans for medical bills

Again, every penny you can claw back or concession you can get from your creditors and billers makes a difference.

5. Get help if you need it

Sometimes meticulously budgeting in a crisis isn’t enough. You may need to ask for help to get through it.

If your financial situation is tight and a light at the end of the tunnel seems far off, then consider what options you have. There are resources and systems in place to help families and individuals who are going through money troubles.

That includes things like unemployment if you lose your job, SNAP benefits (food stamps), housing assistance, and other government programs. Food banks, churches, and even friends and family can also be a source of help when you’re struggling financially.

And remember that even if budgeting your money means making some painful decisions right now it doesn’t necessarily mean your finances are ruined forever.

Credit scores can be rebuilt, emergency savings can be replenished and you can play catch up with retirement if necessary. What matters most is making sure your family’s basic needs are being met right now.

Final Thoughts: Don’t Let a Crisis Derail You Financially

When a sudden shift in your finances happens, it pays to know what to do. And having a solid emergency budget can make a huge difference in how well you’re able to ride out financial storms. These tips can help you get through a crisis when one happens, without giving in to money panic.

Comments are closed.