An emergency fund can be a lifesaver when you have an unexpected expense. Your car breaks down, your kid gets sick, you need to make an unplanned home repair–those are all situations where emergency savings come in handy.

But what if you’ve got $0 in rainy-day savings? Nearly half of Americans don’t, after all.

If you’re starting from scratch with building an emergency fund, don’t panic. You can still grow a nice cushion of cash and I’ve got some tips that can help.

Want Free Money?

Check out my favorite apps for earning cash fast!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions. Get paid to answer questions in your spare time!

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid for your opinion. An easy way to earn extra cash!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

Why You Need to Have Emergency Savings

Having an emergency fund is so important and even more so if you’re living on one income.

Here’s an example of what I mean. Right after I bought a home in 2016, my HVAC system conked out. It was the day before Thanksgiving and I found just one company that was willing to come out and repair it ahead of the holiday.

And of course, they charged me a nice chunk of change for it. The bill was nearly $6,000 but I was able to cover it from emergency savings.

I’ve dipped into my emergency savings other times, too. To make car repairs, fix a leaking roof (homeownership is the best, right?), and take one of our dogs to the vet when she got a raging ear infection.

It’s been there to save me every time.

Emergency savings is a kind of financial insurance. It’s your just-in-case-something-goes-wrong money, your personal oh-sh*t fund.

And you know, something always goes wrong, doesn’t it? It may not be a major thing but even a small unexpected expense could send you scurrying for your credit card.

Now you’re in an even tougher position to save because you’ve got debt to pay down.

If your budget is already tight, that can put even more strain on your money. And that’s an especially big challenge if you’re a one-income family.

I get it. It can be a vicious cycle.

But you can break it. You can build up your emergency savings, even when you feel like you don’t have a dime to spare.

How Much Should You Save for Emergencies?

That’s a good question and there’s no perfect answer.

Some financial experts say three months’ worth of expenses is enough; others might say you need six or nine months’ worth of expenses socked away.

Since I’m a freelancer and earn irregular income, I have well over a year’s worth of expenses in my emergency fund.

Running an online business is great. But just in case all my clients drop off the face of the earth at the same time I want to make sure I have enough in savings to cover the bills until work starts flowing in again.

If you’re starting from zero with saving money for emergencies, it’s fine to go small.

Aim for saving $500 or $1,000 to start. Even $100 in savings is something, especially if you’ve struggled to save anything up to this point.

Once you get that first little bit of cash tucked away in emergency savings, you can work on growing it.

And that’s what I want to help you with. So here are my best tips for growing your emergency fund when money is tight.

How to Build Emergency Savings From Zero

1. Embrace budgeting

Here’s a fun but boring fact: You need a budget if you want to save money and get ahead.

You can make a lot of money or a little but if you don’t budget it wisely, saving money is almost guaranteed to be an uphill battle.

Your budget is your plan for spending each month. And it’s also a tool for saving.

If you don’t have a budget yet, here’s the quick and dirty version of how to make one:

- Add up all of your income for the month, including money you have coming in from a full-time job, part-time gig, freelance work, or side hustles.

- Total up all of your expenses for the month and that means everything you spend money on.

- Subtract the second number from the first one.

Boom–you’ve just made your first rough budget.

That’s a simplified explanation of how to make a budget but that’s enough to get you started.

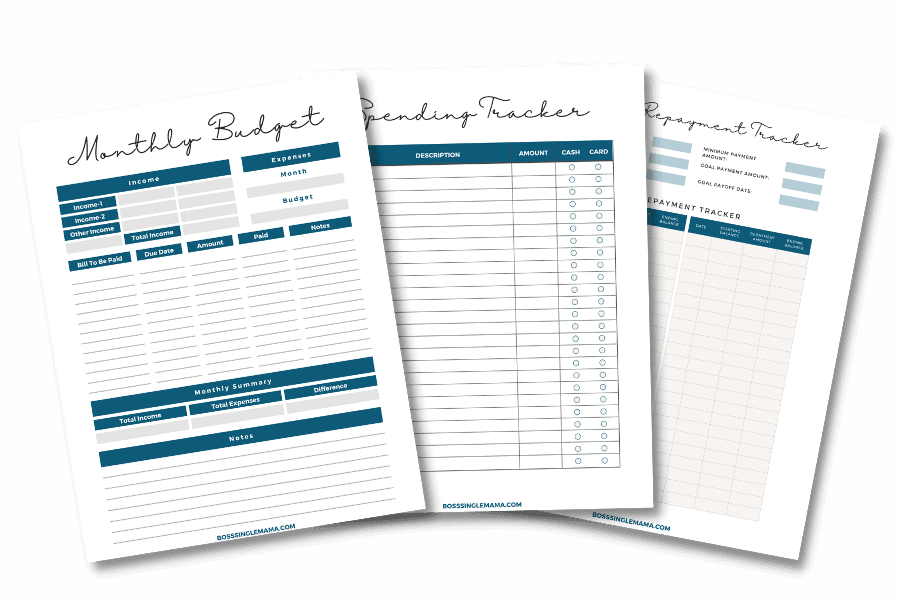

Get Your Budget on Track

Grab these free printable budget templates to take control of your money!

2. Analyze your income

Knowing how much money you have to work with can make a huge difference in how easy it is to build emergency savings. Ask yourself these questions:

- How much money is coming into the household total?

- Where does that money come from?

- Is your income steady and consistent or is it irregular?

Once you know your base income number for the month, you can figure out the best way to put that money to work.

3. Review your spending

Your spending habits can play a big part in how easy (or how difficult) it is to save your first $500 or $1,000 for your emergency fund. The more you can cut the more money you’ll have to save.

Try this. Look at your spending and divide it into three pots:

- Bills or expenses that must be paid

- Essentials that aren’t bills (like groceries and gas)

- “Fun” things you want to spend money on

Now, go back to each pot and look at where the money in it goes. Then ask yourself what you could do to bring the total number down.

For example, could you…

- Adjust the temperature on your thermostat to cut down on energy use and trim your utility bills

- Downgrade your internet or cell phone plan

- Cancel subscriptions that you don’t use (or cut cable if you still have it)

You don’t need to find hundreds of dollars here. The goal is to find small amounts in your budget to start feeding your emergency savings with.

Once you’re in the habit of saving, you can think about bigger possibilities for saving money, like refinancing your mortgage or student loans.

4. Open an emergency savings account

Keeping your emergency fund in your checking account is convenient. It’s also a huge mistake.

It’s easier to spend that money on non-emergencies when it’s sitting there tempting you.

Opening a separate savings account that’s linked to your checking account is the better choice. And an online savings account can help you grow your money faster.

Online banks tend to have lower overhead fees than brick-and-mortar banks. That means they tend to charge fewer fees and they can pay you higher rates on your savings.

Looking for the best high yield savings option? Compare savings account rates online at top banks and credit unions now!

5. Automate your savings plan

Saving is a hard habit to get into if you’re not used to it, no lie.

“Pay yourself first” is a mantra you’ll hear from a lot of finance experts but that’s sometimes easier said than done. Automating can go a long way toward solving that problem.

There are a few different ways you can automate your savings.

For example, if you get paid through direct deposit you could ask your HR department to reroute some of it into a savings account instead of putting it all in checking.

Or you could set up automatic transfers through your bank account every payday. This way, money gets moved to savings automatically so you don’t have time to spend.

A third option, and the one that might be easiest if you’re struggling to grow your emergency fund is letting an app save money for you.

Acorns, for example, scans your bank account and rounds up transactions. Your spare change is saved in an investment account.

It’s super easy and you don’t have to do anything other than sign up for an account and link your checking to start to saving.

6. Try a no-spend challenge

A no-spend challenge can help you kickstart your emergency fund in a hurry.

When you do a no-spend challenge it means you agree to only spend money on essentials for a set time frame. So you might do a spending freeze for a week or a month. Heck, there are some personal finance bloggers out there doing year-long spending diets.

There are some basic rules for starting a no-spend challenge and sticking to it:

- Decide how long you’re going to try a spending diet

- Figure out what your wants vs. needs are

- Set boundaries for what you will and won’t spend money on

- Get the whole family on board

- Track your savings progress

A no-spend challenge can be a little scary if you’ve never done it before. But once you try it, you’ll be amazed at how much money you could save.

7. Save your windfalls

If you’re struggling to make your budget work because your bills are too high or your income is too low, you can use found money to build your emergency fund.

So what’s found money?

In simple terms, it’s any money that comes your way that you weren’t budgeting for or expecting.

That covers things like:

- Tax refunds

- Cash birthday gifts

- Rebates

- Pay raises

- Returned deposits

- Cash bonuses you get for opening a new checking account

It doesn’t matter how big or small these “extra” amounts are. Even $5 helps. It just matters that you commit to saving it.

In fact, it’s better when you’re dealing with small amounts because you may be less tempted to spend any of it.

If you’re getting a $3,000 tax refund, for example, it’s a lot harder mentally to pledge it all to savings when you want to blow some of it on a family vacation or go shopping.

That doesn’t mean you can’t spend anything when you’re trying to grow your emergency savings, though. I’m all for treating yourself occasionally.

Just remember to keep the right balance between spending extra money and saving it.

8. Use apps to save

Money-saving apps can pay you back in different ways.

You might earn cashback on purchases with an app like Rakuten. Or you could earn a few dollars by taking surveys or playing games.

The great thing about using apps to build an emergency fund is that you can sign up for more than one and most of them are free to use. And they’re easy ways to make money in your spare time.

If you need some recommendations for money-saving apps, here are my top picks:

Learn how to make money with Rakuten and how Rakuten makes money.

Or sign up to start earning cash back and earn an introductory bonus!

Want to Get Cash Back When You Shop?

Making extra money is easy with Rakuten!

Rakuten is a free app and browser extension that helps you find coupons and discounts when you shop online or in stores. You can earn up to 40% cashback when you shop at hundreds of partner retailers, plus get a $10 sign-up and extra cash for each person you refer!

9. Increase your income

If you can’t eke out even $5 a month to save, it’s time to think about what you can do to bring in more money each month.

There are so many ways to do this and a lot of them you can do from home.

For example, check out these online business ideas that are great for moms:

- Become a freelance writer and get paid to write for blogs or websites

- Start a virtual assistant business and work flexible hours

- Teach classes for kids on Outschool

- Learn how to proofread or get paid to be an editor

- Make homemade crafts and sell them on Etsy

- Get paid to transcribe

- Monetize a TikTok channel

- Start a YouTube channel or podcast

There are things you can do offline to make extra money too, like offering childcare in your home for other moms. Or you could start a dog-walking business through Rover.

Starting a blog is another option for making money online.

The four biggest ways you can make money blogging are affiliate marketing, sponsored posts, ads, and selling your products.

Now, let me be upfront and say that there can be a HUGE learning curve with blogging. But a blog could be a great way to bring in extra cash from home and grow your emergency savings.

Ready to start a blog or website? It’s easy to get started with a custom domain and hosting through Siteground. Plans are affordable, which is perfect for beginners!

Final Thoughts: Start Building Emergency Savings Today

Having an emergency stash of cash in the bank can help you sleep better at night since you don’t have to worry about an unexpected expense derailing you financially. The tips I’ve shared here are some tried and true ways to grow your emergency fund when you’re starting from scratch. Don’t forget to share this post if you found it helpful!

Comments are closed.