Last Updated on November 12, 2022 by Rebecca Lake

Budgeting can make it easier to get ahead financially. And 8 in 10 Americans say they make a plan for spending each month.

Cash envelope budgeting is one of the most popular ways to manage money. But if you’d rather not keep up with multiple envelopes of cash, you could try a digital envelope system instead.

The digital envelope system allows you to divide your discretionary spending into different categories. But instead of using physical envelopes to keep track of expenses, you use an app or subaccounts at your bank instead.

Digital cash envelopes can help you stay organized, without having to worry about losing a paper envelope. And you don’t have to carry large amounts of money in a cash envelope wallet either.

Wondering how to implement a digital envelope system? Here’s a closer look at how it works.

Related post: Cash Envelope System for Beginners (Get Started in 3 Easy Steps)

LIKE FREE MONEY?

Here are some of my go-to apps for earning extra cash!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid, no special skills or experience required!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

What Is a Digital Cash Envelope System?

Cash envelope budgeting involves dividing up money into different envelopes each month to represent individual budget categories. For example, your cash envelope system categories might include groceries, gas and dining out.

You’d make purchases in those budget categories using cash. Once you spend all the cash in an envelope you can’t spend anything else in that category until the new budget period begins.

The digital envelope system works the same way. Only instead of putting cash into envelopes, you’re using a budgeting app or subaccounts inside your main bank account to spend.

Using digital cash envelopes in place of paper envelopes has three main benefits:

- It’s safer. Carrying envelopes of cash can be problematic if you lose them or your wallet gets stolen. Keeping envelopes inside an app or bank account, on the other hand, is more secure.

- It’s convenient. Paying with a debit card can be easier than paying with cash in certain situations. For example, if you’re getting gas you may prefer to pay at the pump with your card versus walking in to pay with cash.

- It’s organized. Using cash envelopes means you have to be diligent about writing down purchases. Otherwise, you could lose track of how much you have left to spend. A digital envelope system lets you see what you have available to spend at a glance, no math required.

Digital cash envelopes can help to simplify budgeting since you can easily keep track of spending. And you don’t have to worry about withdrawing cash each pay period.

Related post: How to Make a Budget When You Hate the Idea of Budgeting

Looking for a simple money management tool? Empower makes it easy to track spending, saving, investing, and budgeting in one place so you can tackle your financial goals!

How to Start a Digital Envelope System

Setting up your budgeting using digital cash envelopes isn’t complicated. There are three basic steps you’ll need to take to start budgeting with digital envelopes.

1. Make your budget

The first thing you’ll need to do is make a budget.

There are different budgeting methods you can use to budget with digital envelopes. For example, you might try:

- 50/30/20 budgeting

- Budgeting by paycheck

- Half payment method budgeting

- Zero-based budgeting

- Dave Ramsey budget percentages

Your budget will have fixed expenses that stay the same from month to month. That includes things like your rent or mortgage payment or insurance premiums.

You’ll also have variable expenses that might fluctuate each month. So your utility bills may be different, depending on how much energy you use.

And you may also have certain expenses you only pay quarterly, semiannually or annually. Setting up sinking funds that are separate from your digital cash envelopes can help you keep track of those expenses.

Tracking your spending for a month can give you a better idea of what you’re actually spending. That can make it easier to make your budget.

Related post: Why Is Budgeting Important? (10 Life-Changing Benefits of Budgeting)

2. Choose your digital cash envelope categories

Once you’ve made your budget, the next step is deciding which envelopes to include in your digital envelope system.

When you’re budgeting with paper envelopes, you typically limit your cash envelopes to discretionary spending. So again, you might have envelopes for things like groceries, gas, clothing or personal care.

With digital envelope budgeting, you can add those same categories. But you can also set up digital envelopes for other things like bills, savings or debt repayment.

So how many digital cash envelopes should you use?

For paper envelopes, 5 to 7 is usually a good number to shoot for. That’s enough to cover your biggest discretionary spending categories but not so many that you’ll get overwhelmed.

If you’re using digital envelopes, you have more leeway since you’re tracking expenses online. That means you be as broad or narrow as you like when choosing your spending categories.

So you might set up digital cash envelopes to include:

- Gas

- Transportation (i.e., vehicle maintenance, oil changes, repairs, public parking, tolls, etc.)

- Groceries

- Dining out

- Personal care/self-care

- Recreation and hobbies

- Entertainment

- Travel

- Utility bills (including electric, gas, water/sewer, cell phone and internet)

- Debt repayment

- Emergency savings

- Retirement savings

- Sinking funds

The great thing about a digital envelope system is that you can experiment to figure out what works best for you. And it’s easy to add new envelope categories as needed or remove them as your spending habits change.

Related post: 90+ Cash Envelope Categories to Help You Budget More Effectively

3. Add money to each envelope

After you’ve created your digital envelopes, the final step is adding money to each one. This is where the budget you made in step one comes in.

If you’ve made your budget, then you should know how much money to allocate to each digital cash envelope.

For example, your envelopes might look like this:

- Groceries: $600

- Gas: $250

- Personal care: $150

- Recreation/hobbies: $150

- Miscellaneous: $100

How often you add money to each envelope can depend on how often you’re paid.

For example, if you budget by paycheck and are paid biweekly, then you may put money in your envelopes every two weeks. So if you’ve budgeted $600 for groceries, you’d add $300 every other payday.

On the other hand, you might decide to fill up all of your envelopes at the start of the month if you have cash available to do so. Getting one month ahead on bills can make this easier to do.

Where to Set Up a Digital Envelope System

As mentioned, there are two ways you can assign money to your digital envelopes: through an app or your bank. The option you choose ultimately depends on how you prefer to manage your money.

1. Digital cash envelope budgeting apps

There are several apps you can link to your bank account for digital envelope budgeting. You download the app, sync your bank account login, set up your envelopes and the app does the rest!

You might use an app for managing digital cash envelopes if you:

- Want to be able to see your available “cash” at a glance

- Don’t want to have to track spending separately

- Are comfortable using online budgeting apps already

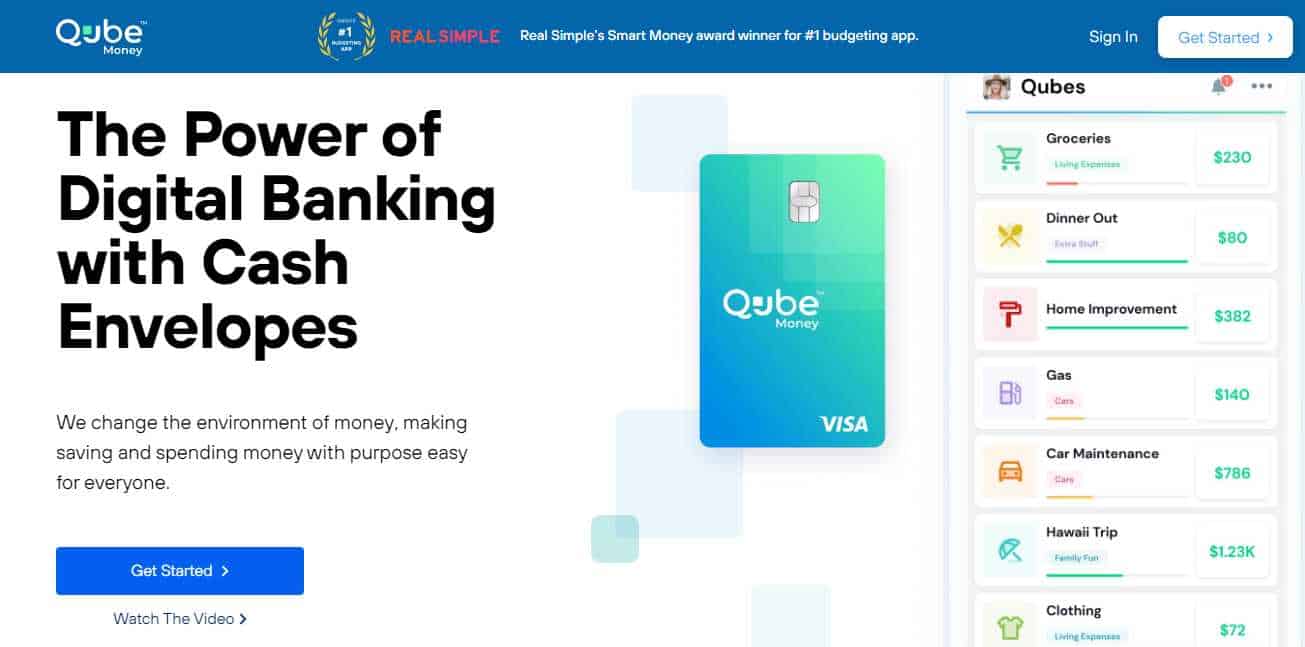

If you’re interested in trying out an app for digital cash envelopes, I recommend Qube Money.

This award-winning budgeting app is designed specifically for people who prefer the cash envelope system. Here are some of the highlights of Qube Money:

- Set up individual tracking or joint accounts (perfect for budgeting as a couple!)

- Customizable automated bill payments

- Automated spending tracking

- Transactions are secure with the Qube Card

- FDIC-insured banking

- Open savings accounts for kids to teach them about budgeting

- Get paid up to two days early with direct deposit

- Compatible with Apple Pay and Google Pay

- Set up 10 digital cash envelopes and manage your money for free!

Qube is a great all-around money management app and it’s worth a look if you’re ready to try digital envelope budgeting.

2. Subaccounts at your bank

A subaccount is a secondary account that’s linked to your main bank account. Not all banks allow subaccounts for checking accounts but if yours does, this could be another way to manage your digital cash envelopes.

Here’s how it would work.

- You’d open subaccounts for each of your digital cash envelope categories

- Those subaccounts are linked to your main checking account

- You transfer money from checking to each of your subaccounts

- As you spend, you can select which subaccount the money should come from

Compared to using an app like Qube Money, the subaccount method can be a little more involved. And again, your bank may not offer this option.

If you’re able to use subaccounts, keep in mind that you may need a separate system for tracking your expenses.

You could use an Excel spreadsheet, for example, or a simple expense tracker. Either way, you’ll want to make sure you’re not overspending from your subaccounts since that could trigger overdraft fees.

Looking for a simple money management tool? Empower makes it easy to track spending, saving, investing, and budgeting in one place so you can tackle your financial goals!

FAQs

What are digital cash envelopes?

Digital cash envelopes are virtual envelopes that hold money for individual budget categories. You can set up digital cash envelopes using a budgeting app or by creating subaccounts that are linked to your main bank account.

How do you use a digital cash envelope?

Digital cash envelopes can be used to make bill payments, cover variable expenses or pay for discretionary spending. You deposit money into each envelope via a bank account transfer, then spend it using your debit card or ACH payments. Once the money in an envelope has all been spent, you can’t spend anything else in that budget category until the new budget period begins.

Are cash envelopes a good idea?

Using a cash envelope system to budget can help you to rein in overspending since you can only spend the amount allocated to each envelope. Digital cash envelopes can help you to stay organized and avoid impulse purchases, without having to carry large amounts of cash wherever you go.

Final thoughts on the digital envelope system

Using digital envelopes for budgeting can help you to stop spending money on things you don’t need, which can help you to save more. Qube Money users, for example, save $440 a month on average with the digital envelope system.

And it can be an easier way to budget than using spreadsheets or complicated expenses trackers. That might sound good to you if you’re looking for ways to simplify your finances.

Do you use digital cash envelopes to budget? If so, tell me about it in the comments.

Don’t forget to check out my favorite Smart Money Tools for making and saving money!

Need more budgeting tips? Read these posts next:

- 60/30/10 Rule Budget Explained (and Can It Make You Rich?)

- 70/20/10 Budget Method: How to Use It to Spend, Save and Invest

- Budget Percentages Explained: 3 Easy Ways to Create Your Ideal Budget

- 12 Best Budgeting Planners to Take Control of Your Money

- 30-30-30-10 Budget Explained (Pay Your Bills and Still Have Fun!)

- What Is a Sinking Fund? (An Ultimate Guide to Sinking Funds)