A budget is a plan for spending money each month. Knowing how to make a budget is an important personal finance skill.

Surprisingly, roughly 15% of Americans say they don’t budget at all. If you’ve never learned how to make a budget or struggle with sticking to one, this guide to budgeting for beginners is just for you.

Want Free Money?

Check out my favorite apps for earning cash fast!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions. Get paid to answer questions in your spare time!

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid for your opinion. An easy way to earn extra cash!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

Why You Need a Budget

Why is budgeting important? Simply because it puts you in control of your money.

Without a budget, it’s much easier to lose track of spending. You could end up in debt if you’re relying on credit cards to cover expenses and spending more than you make. That can lead to money stress.

When you learn how to make a budget it becomes easier to:

- See where your money is going

- Figure out what you’re wasting money on

- Create a plan for paying down debt

- Build an emergency fund for rainy days

- Save and invest for retirement or your kids’ college

- Plan out your financial goals

- Understanding your spending patterns and triggers

- Stop freaking out over money

That last one is really important.

When I first became a single mom, I spent so many nights worrying about money and how I was going to pay my bills.

I was in the early stages of building my freelance writing business and my income was a fraction of what it is now. I had some debt to pay off and I was freaked out about how I was going to make it work.

Learning how to make a budget saved me a lot of headaches.

And it can do the same for you too. As you get into the budgeting habit, you get smarter about where your money goes. And that can make a HUGE difference when it comes to your financial situation.

What to Know About Budgeting for Beginners

Making a budget isn’t that complicated. I’ll walk you through how to make a budget and share some tips that can help you stick with your spending plan. But first, here are two preliminary steps to tackle that can set you up for success.

Understand why you’re making a budget

Before you start adding up numbers, ask yourself one question: why do you want to make a budget?

A budget isn’t just all about numbers; it’s also about your mindset. How you view your budget — whether you see it as a tool for gaining control over your money or a medieval torture device, for example — matters.

Because here’s the truth. If you don’t have the right mindset about budgeting, it will never work.

Your “why” is tied to your goals. For example, do you want to make a budget so you can:

- Pay down debt

- Start building savings more consistently

- Pinpoint where you’re wasting money

- Feel more in control of your family finances

Whatever your reason for budgeting, nail it down. This is going to be your motivation to keep going when budgeting feels like a total drag.

Choose your budget method

When you make a budget, you’re telling your income what to do and where to go. But there are lots of ways you can divide up the income that you have to cover your expenses.

Here are some of the most popular budget systems you might try:

You might test out different methods to figure out which one works best for you. There’s no right or wrong answer here–the goal is to choose a budget system that’s going to be easiest for you to stick with.

Aside from budget methods, there are different ways to track your budget. You could use:

- Budgeting apps

- Budgeting software programs

- Budget worksheets

- Budgeting spreadsheets

Apps are great because you can sync up all of your bank accounts and credit card accounts in one place to track your spending. Empower (formerly Personal Capital) is the app I recommend but there are plenty of others to choose from.

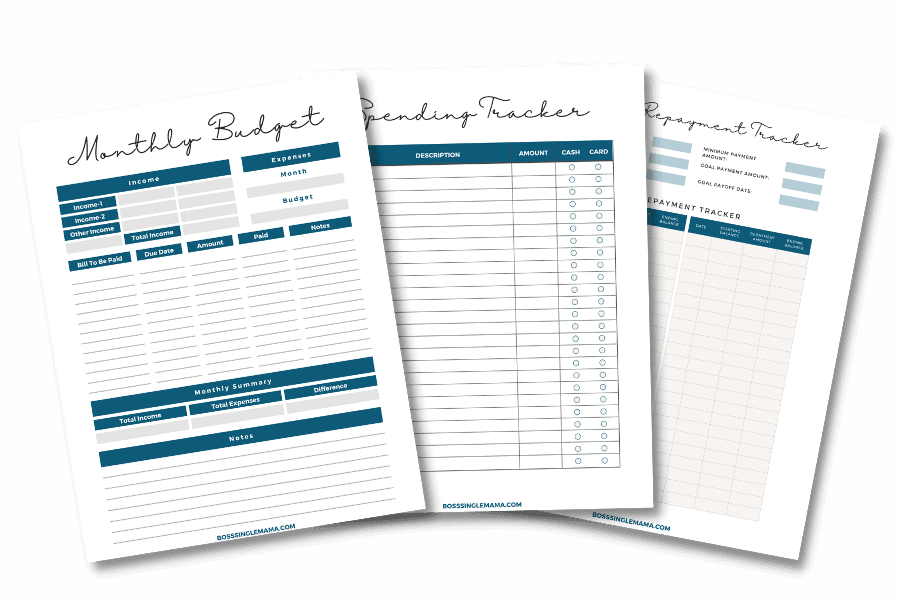

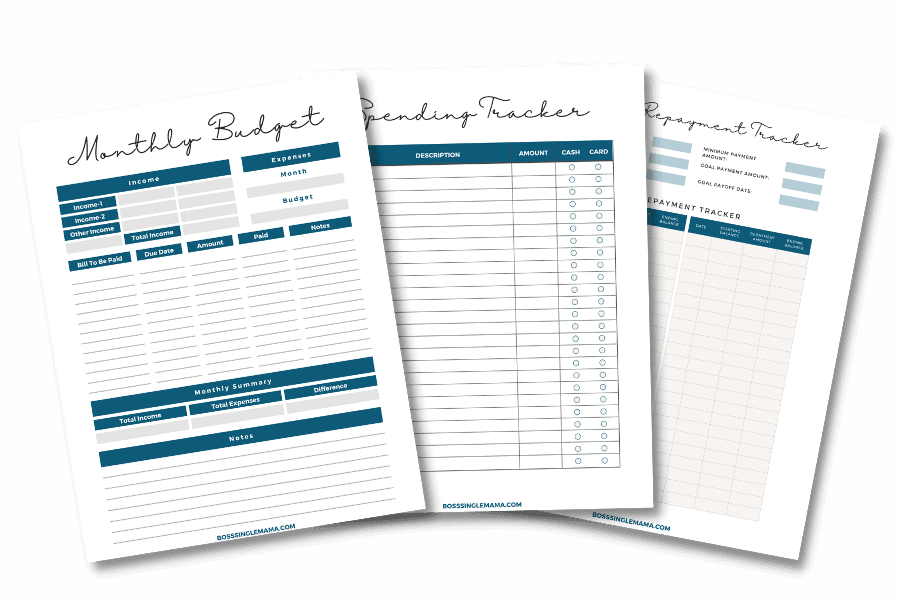

On the other hand, you might prefer a worksheet or spreadsheet if you’d like to enter things manually. You can grab my free budget worksheets by clicking the button below (no email sign-up required).

Get Your Budget on Track

Grab these free printable budget templates to take control of your money!

How to Make a Budget Step-by-Step

Ready to get your budget going? Here’s how to make a budget from scratch!

Step 1: Choose your budget categories

The first step is deciding what budget categories to include. That just means how you’re going to identify different things that you spend money on.

If you’re not sure where to start, you can use these three buckets as a jumping-off point: Needs, wants, and savings/debt repayment.

Needs are everything you need to spend money on to live. That includes:

- Rent or mortgage payments

- Water and electric bills

- Food

- Cellphone and internet service

- Transportation

- Insurance

- Childcare (if applicable)

Wants are things you choose to spend money on. They’re not essential expenses since you could live without them. Some of the “wants” in your budget might include:

- Eating out

- Salon visits

- Entertainment

- New clothes or furniture

- Travel

- Kids’ activity or extracurricular fees

- Gym membership

- Streaming services

Your list may look different and that’s okay. The key is to be able to separate your needs and wants, especially if you’re working with a tighter budget.

The last budget category to include is savings and debt repayment. This is where you’ll earmark money for things like:

- Transfers to your emergency fund

- Retirement plan contributions

- Credit card payments

- Payments to student loans or a car loan

You can get even more detailed with your budgeting categories but these three buckets are a good place to start.

Step 2: Add up your expenses

Once you’ve got your categories down you can go to the next step in how to make a budget. Here, you’ll add up everything that you plan to spend money on for the month.

Some of your expenses are most likely fixed, meaning the amount is the same each month. Examples of fixed expenses include housing payments, insurance premiums, and cell phone or internet bills.

Other expenses are variable and can change from month to month.

So, one month your electric bill might be $300 but the next month it’s $150. Reviewing your bank account statements for the past six months can give you a better idea of how much you spend on average month to month for variable expenses.

You can use an expense tracker worksheet or a budgeting app to keep track of where your money goes and categorize expenses. That can be pretty eye-opening if you’re used to spending without giving much thought to which categories get most of your money.

Step 3: Add up your income

There are two parts to a budget: what you have coming in and what you have going out.

If you’re going to make a budget you can stick to you need to know how much income you have to work with. That can include income from:

- Full-time jobs

- Part-time jobs

- Side hustles

- Businesses you run

- Alimony and child support

- Government or disability benefits

- Rental homes you own or other investments

- Interest income from high-yield savings accounts or CDs

Having multiple streams of income is a good thing since it means you have more money to budget with. But you can still budget effectively if you’re a one-income family.

Here’s how to manage the income side of your budget:

- Add up all of the income that you can count on for the month

- Make a note of the amount, when you can expect that income to arrive, and where it’s coming from

- Decide how you’re going to divide it, based on how frequently you get paid

Some people budget all of their income at the beginning of the month. Others budget weekly or biweekly, depending on how they’re paid.

If your income is irregular, meaning it changes from one month to the next, calculate what you make on average based on the last 12 months. Then use that number as your baseline for budgeting.

Step 4: Subtract expenses from income

So, by now you should have your income on one side and all your expenses on the other.

Here’s the final step in how to make a budget: Subtract your expenses from your income.

Wait…what? Is that all? Yep, it’s that simple.

Now, look at the number you got from subtracting your expenses from your income.

Is it a positive number? If so, that’s awesome. It means you’re living below your means and that’s one of the keys to financial security.

But what if you don’t have enough income to cover your bills?

It usually means one of two things. You’re either overspending or you’ve cut your expenses down as much as possible but they’re still too high for your income.

So how do you fix it?

First, you go back through your budget line by line to see what you can reduce or cut out altogether.

If you’ve already tightened your budget down as much as you can, then it’s time to see what you can do on the income side.

The great thing about finding money to make a budget work is that there are so many possibilities.

For example, you could:

- Take on more hours at work

- Get a part-time job

- Start a side hustle

- Launch an online business

- Start freelancing

- Get paid to do odd jobs

- Start an Etsy shop

- Sell things around the house for cash

- Make money taking surveys

Make Quick Cash With Survey Junkie

Take surveys. Earn rewards. Get paid.

Making extra money is that easy when you create an account with Survey Junkie. It’s free to sign up and you can earn real cash in your PayPal account or free gift cards, just for answering questions and sharing your opinions.

How to Stick to Your Budget

You can’t make a budget once then forget about it.

You have to check in with your budget at least once a month to stay on top of what you’re spending and saving.

If that’s a struggle, here are a few things you can do to make budgeting a regular part of your life.

- Make a regular budget date each month. Commit to using this time to go over your expenses and income. Set a reminder on your phone’s calendar so you don’t flake out and forget about it.

- Create a positive ritual to make your monthly budget date less anxiety-inducing. Repeat a positive money mantra, meditate on your financial goals for 10 minutes or just have a glass of wine. Sticking with a regular warm-up routine lets your brain know that it’s time to focus on your budget.

- Get organized. If you prefer paper bills or statements, set up a basket or file folder for collecting them each month. If you get electronic statements instead, set up a folder for those in your email and file them as they come in.

- Treat yo self! Did you make a budget and stick to it all month? Sweet! Give yourself a small reward. Having something to look forward to could give you the mental push you need to buckle down and stay on budget.

Get Your Budget on Track

Grab these free printable budget templates to take control of your money!

Final Thoughts: Learn How to Make a Budget and Get Ahead Financially

Budgeting might seem scary or intimidating but it’s really not that hard to do. You have to learn the mechanics of how to make a budget first, then develop positive money habits that can help you stick with the financial plan you’ve created. If you found this post helpful don’t forget to share it with someone who could use some budgeting help. And remember to grab your free budget printables!

Comments are closed.