Last Updated on May 13, 2023 by Rebecca Lake

Being a single mother can be incredibly challenging, especially when it comes to money matters. If you’re parenting solo, either by circumstance or by choice, you might be wondering how to survive financially as a single mom.

Single parents, especially single mothers, are often no strangers to financial struggles. Nearly 25% of households headed by single moms live at or below the poverty line, according to the U.S. Census Bureau. The poverty rate among single mothers is nearly double that of single-father families.

Do single moms struggle financially? Many do. But the good news is that it’s possible to get ahead financially as a single parent.

Today, I’m sharing my most important financial tips for single moms to help you not only survive, but thrive.

LIKE FREE MONEY?

Here are some of my go-to apps for earning extra cash!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid, no special skills or experience required!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

How to Survive Financially as a Single Mom

Single parenting can be a struggle to make ends meet, especially if you’re adjusting to living on a single income after being a dual-income family, or if you live on a low income. Knowing what steps you can take to improve your money situation can help you minimize financial stress while navigating single motherhood.

Here are some tried and true tips for how to survive financially as a single mom, from a single mom who’s been through the struggle.

1. Assess your financial situation

Making a financial survival plan as a single mom starts with knowing where you are right now. Taking a close look at your income and expenses to see how much money you have coming in and going out is the first step.

Household income includes any money you have coming in from:

- Working a 9 to 5 job

- Part-time employment

- Self-employment

- Side hustles

- Alimony

- Child support

For perspective, the median income in the U.S. is around $71,000. Yours might be higher or lower as a single mom but it’s important to know your number.

Next, subtract all of your expenses, starting with the bills you need to pay to meet your family’s immediate needs. That includes things like rent or mortgage payments, utilities, food, transportation and child care.

Doing this simple calculation can give you a clearer picture of your money situation and help you identify areas where you can cut back or save.

2. Separate your finances if needed

If you’re embarking on the single mom journey after a breakup or divorce, one of the first things you’ll want to do is decide how to manage any shared accounts.

It could make sense to keep a joint bank account open if your ex will be depositing child support or alimony into it. But it’s a good idea to have a checking account in your own name that they can’t touch.

You’ll also need to consider how to separate shared debts.

For example, if you own a home together you might need to reach out to your mortgage lender to ask about refinancing. And it’s usually a smart move to close joint credit card accounts since both of you would be legally responsible for the balance, even if only one of you is charging things.

Being stuck with extra debt can be a roadblock to how to survive financially as a single mom. It’s probably wise to talk to a divorce attorney, accountant or financial advisor about how to handle any joint accounts or debts if you’re going through a split.

3. Make a budget

A single mom budget is an essential tool for managing your money and staying on track with your financial goals. The more committed you are to sticking to a budget, the easier it is to curb or even avoid certain money problems.

Here’s a simple guide to making a budget:

- List all of your expenses each month

- Divide those expenses into different budgeting categories

- Subtract total expenses from total income (net income, not gross income)

The end number is what you should have left over from income each month after all your expenses are paid.

What if you’re in the red and you don’t have enough money to cover all of your bills? Then you move on to the next step.

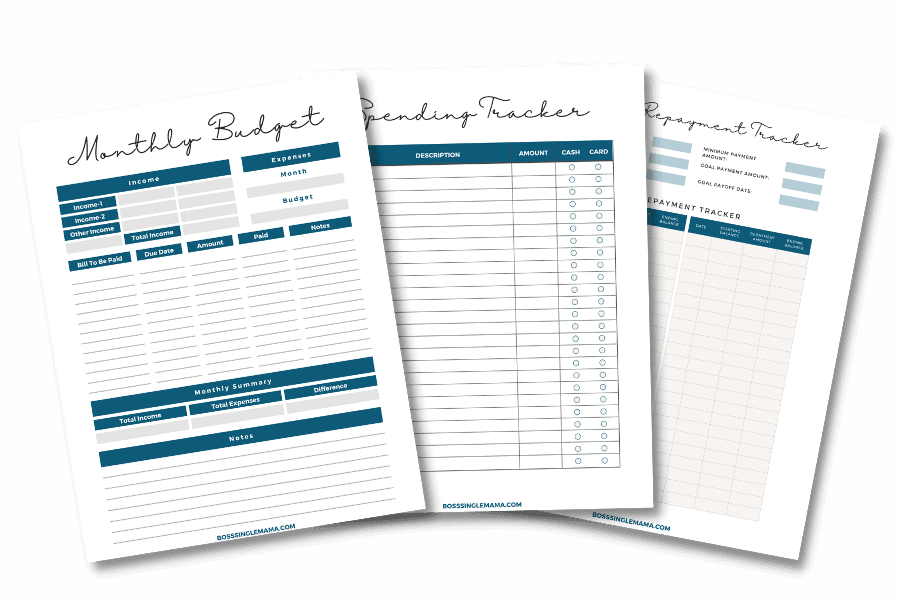

Get Your Budget on Track

Grab these free printable budget templates to take control of your money!

4. Rethink your spending

When you’re trying to figure out how to survive financially as a single mom, reducing expenses is one of the best things you can do for yourself in the long run.

If you’ve made a rough budget and there’s no extra money left in your bank account once all the bills are paid then it’s time to take a closer look at what you’re spending.

So what could you cut? Some of the things you could stop spending money on to save include:

- Subscription services you don’t need or use

- Gym memberships

- Take-out meals

- Higher-end phones or pricey phone plans (switching to prepaid cell phone service saved me $600 a year!)

- Cable TV

- New clothes or toys (we were and still are thrift store junkies!

If you’re not sure what to cut, a tool like Trim can help. Trim is a financial assistant that can review your spending and find the dead weight in your budget.

And if you really want to go extreme, you might consider getting rid of your car in favor of public transportation, downsizing to a smaller home or moving in with family or friends to slash spending.

5. Embrace frugal living

Adopting a frugal lifestyle is a great way to save money and it’s one of the most helpful tips for how to survive financially as a single mom.

Being frugal doesn’t mean being cheap. Instead, it means being mindful of how and where you spend the money that you have.

For example, when I was a newly single mom with a 5- and 6-year-old and no job I knew I couldn’t afford to be spending a lot of money on anything that we didn’t absolutely need. So I trimmed our budget down to just the basics: rent, groceries, gas, utilities and car insurance.

Make Quick Cash With Survey Junkie

Take surveys. Earn rewards. Get paid.

Making extra money is that easy when you create an account with Survey Junkie. It’s free to sign up and you can earn real cash in your PayPal account or free gift cards, just for answering questions and sharing your opinions.

Instead of spending money on “fun” things, we found ways to enjoy ourselves at home. If we did go out, it was to do something free like the summer reading program at our local library or movies in the park hosted by the town government.

And honestly, my kids had a great time. So if you’re worried about whether living frugally might create a happiness gap with your kids, I can tell you from experience that spending time together provides a bigger payoff than spending money.

6. Make building an emergency fund a priority

An emergency fund is a savings account that you can tap into in case of unexpected expenses or emergencies. If you don’t have emergency savings, my best advice is to focus on that first once you’ve got your budget under control.

How much should a single person save for emergencies?

Most financial experts say that saving three to six months’ worth of living expenses should be the goal. But if you’re a single mom with minor children living on a low income, you might have to set a smaller target at first.

So, you might set a goal of saving $1,000 for emergencies to start, then build on that goal as time goes by.

Even if you can only save $10 a week, that’s still something. And you can help your money grow faster by keeping it in a high-yield savings account.

7. Get a handle on debt

Debt can weigh you down as a single mom. Once you meet your family’s basic needs and make payments to credit cards, student loans or a car loan, there might be nothing left over in your budget to save.

If you have debt, then paying it off is an important goal. There are a few things you might be able to do to get rid of debt faster, including:

- Transferring high-interest credit card balances to a new card with a 0% APR.

- Refinancing your mortgage at a lower interest rate if you own a home.

- Taking out a debt consolidation loan to pay off credit cards or medical bills.

- Refinancing private student loans at a lower rate.

The more you can save on interest, the easier it may be to chip away at what you owe.

If you’re interested in a 0% APR balance transfer credit card, you can compare offers on Credit Karma. And if you’d like to get an affordable personal loan to consolidate debt, check your rates on Upstart.

Looking for a simple money management tool? Empower makes it easy to track spending, saving, investing, and budgeting in one place so you can tackle your financial goals!

8. Work on your credit score

Your credit score is a financial report card that tells lenders how responsibly you manage money. So why does that matter when you’re trying to figure out how to survive financially as a single mom?

A higher credit score can make it easier to borrow money and get the lowest interest rates.

If you’re trying to get a debt consolidation loan, for example, or refinance your mortgage then a good credit score can go a long way when it comes to saving money on interest.

You can check and monitor your credit score for free at Credit Karma. And you can get tips on how to improve your score over time.

9. Get assistance if you need it

If you’re really struggling with how to survive financially as a single mom, there are several federal programs and financial assistance options available for low-income families.

For example, financial help for single moms can include:

- Temporary Assistance for Needy Families (TANF), which provides cash assistance

- Supplemental Nutrition Assistance Program (SNAP), which offers benefits to help you pay for food (a.k.a., food stamps)

- Women, Infants and Children (WIC), which provides food assistance to mothers of infants and young children

- Pell Grant program, which can provide you with money to go back to school as a single mom so you can reach your career goals

In addition to federal government programs, you can also seek financial assistance from local churches or nonprofit organizations

Many of these organizations provide free services, such as financial counseling, budgeting workshops and job training programs for single parents.

10. Get the right insurance

Insurance is designed to protect you and your family financially and there are different types of insurance that are good to have as a single mom.

Health insurance is at the top of the list, especially if your kids tend to get sick a lot.

If you have a full-time job, you might have health insurance through your employer. If not, it’s worth looking into Medicaid or the Children’s Health Insurance Program (CHIP), which can provide free or low-cost health care to eligible families.

Life insurance is another important consideration for single mothers.

A life insurance policy can provide financial support for your children in case you pass away unexpectedly. Term life insurance is a great option for single moms since it tends to be more affordable than permanent policies.

For example, a $500,000 policy could provide financial security and peace of mind in case you develop a terminal illness or pass away as a result of an accident. That money could help to pay basic living expenses or even put your kids through college when the time comes.

If you’re interested in getting a term life insurance policy, you can get a free quote from Haven Life.

11. Review your tax situation

If you’re a newly single mom, you may be facing a new tax situation if you’re filing a return without a spouse.

For example, you might be wondering which filing status to claim (head of household, married filing separately or single) and which tax credits or deductions you may be eligible for.

Here are some of the tax breaks you may be able to claim as a single mom:

- Child Tax Credit

- Earned Income Tax Credit (EITC)

- Child and Dependent Care Credit

- American Opportunity Tax Credit or Lifetime Learning Credit

You may also want to check your withholding if you work a regular job and get taxes deducted from your paycheck. Adjusting your withholding could put some extra cash back into your check each pay period.

12. Look for affordable childcare

Child care can be one of your biggest expenses as a single mom. Finding ways to minimize child care costs can help you stretch your budget further.

For example, you might ask a relative to watch your child for you while you work during the day or after school if they’re school-aged.

You could also look for government-sponsored child care programs, such as Head Start or the Child Care and Development Fund.

Head Start is free for eligible families but if your child is too young for school, you may be able to get free money to pay for daycare in the form of government vouchers.

13. Find ways to increase income

Here’s my personal secret for how to survive financially as a single mom: make more money.

Speaking from experience, the best way to feel financially secure as a single mom is to increase income. The more money you can bring in, the easier it is to meet the needs of your family and reduce financial stress.

There are several ways you could create extra income each month, including:

- Negotiating a pay raise at your current job

- Taking on extra hours if you work an hourly job

- Getting a part-time job in addition to your full-time gig

- Starting a side hustle (or two, or three)

- Launching your own small business

- Selling things around the house you don’t need

When I was a newly single mom, I did not have a regular job outside the home. But I did have a small freelance writing side hustle that brought in around $1,000 a month.

I decided to turn that side gig into a full-time business and today, I make multiple six figures a year from writing. I also have some smaller side hustles, including an Etsy shop, several blogs and an Amazon KDP store. And I do all of these things from home while homeschooling my kids.

So, if you’re thinking that you can’t find ways to make extra money to be a stay at home single mom, let me assure you that it’s definitely possible. You just have to figure out what money-making ideas work best for you.

You can check out these posts for inspiration on ways to make money as a single mum:

- 33 Best Side Hustles for Women (Make Extra Money Now)

- 25 High Paying Side Hustles for Single Moms

- Free At Home Jobs for Moms: 25 Legitimate Remote Work Options

- 50+ Flexible Side Hustles for Moms Who Want to Make Extra Money

Want to get paid to proofread?

Sign up for a FREE webinar to learn how to make money proofreading online!

14. Take care of yourself

This isn’t specifically a money tip but it’s still relevant to how to survive financially as a single mom.

As a single parent, your mental health can suffer because you’re responsible for so many things.

For example, you may be laser-focused on taking care of your kids and keeping up with chores, while also trying to stay on top of the bills. That can result in you spending no time caring for yourself, but that can backfire in the long run.

Making sure that you’re getting enough sleep, exercising regularly and carving out a few minutes of each day to re-center, meditate or simply grab a moment alone is important. Your kids need quality time with you but you also need quality time with yourself.

Single mom burnout is real and if you allow it to take over, that can play out in negative ways. For example, you might be tempted to spend money on things you don’t need for a quick mental boost, which could set you back on your goals.

Having a supportive network can help. This includes close family members, friends, and other single-parent families who can offer a lot of help and support.

You can also join online communities or support groups for single moms to connect with others who are going through similar experiences. Having someone to talk to can help relieve some of the stress you might be feeling about money or mom life in general.

The bottom line on how to survive financially as a single mom

Financial difficulties are all too real for many single mothers. Ultimately, the key to how to survive financially as a single mom is to take control of your finances and make smart money decisions. That means being proactive about managing your income and expenses, creating a budget, building an emergency fund and seeking out financial assistance if you need it.

In addition to financial planning, prioritizing your health and well-being while managing day-to-day responsibilities is also important. If you’re embarking on a new life as a single mom, you may be flying solo for a long time. So it’s important to care for yourself financially, mentally, emotionally and physically along the way.

Need more money tips? Read these posts next:

- 29 Money Saving Tips for Single Moms [Cut Your Budget Instantly!]

- 9 Smart Financial Tips for Single Mothers (Build Wealth as a Single Mom)

- How to Make Money Fast as a Woman

- 30 Inspired Gifts for Single Moms (Thoughtful, Fun and Practical!)