Ever wondered how single moms survive financially?

Being a single mom is challenging on many levels, especially where money is concerned. Low income, high child care expenses and expensive debt can make saving money and building wealth seem impossible.

If you’re a single mom struggling financially, the good news is that you can turn your situation around. Today, I’m sharing some of the best financial tips for single mothers to help you take control of your budget, start saving and grow wealth.

Related post: How to Get Rich From Nothing (10 Secrets to Become a Millionaire)

LIKE FREE MONEY?

Here are some of my go-to apps for earning extra cash!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid, no special skills or experience required!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

How Do Single Moms Survive Financially?

The short answer is that we do whatever it takes.

The long answer is a little more complex. Because the reality is that every single mother’s financial situation is different.

Globally, 13% of unmarried women worldwide have children under 15 living in their households. In the U.S., that number rises to 19% of unmarried women.

Among female-headed households in the U.S., the poverty rate is 23.4%, according to the Census Bureau. So for many single moms, the financial struggle is all too real.

The secret to how to survive financially as a single mom comes down to three things:

- Decreasing expenses

- Increasing income

- Saving more money

This is the exact formula I used to completely makeover my financial life as a single mom of two kids.

In 2014, I was a broke single parent of two young kids. I had a small amount of savings and no job. Today, I make a six-figure income from home and it’s all because I was able to cut spending, save and grow my income.

If you can master those things too then you’re virtually guaranteed to see a positive change in your financial situation. And if you’re not sure where to get started with either one, I’ve got some financial tips for single mothers that can help.

Related post: 30 Inspired Gift Ideas for Overwhelmed Single Moms

Looking for a simple money management tool? Empower makes it easy to track spending, saving, investing, and budgeting in one place so you can tackle your financial goals!

9 Financial Tips for Single Mothers to Build Wealth

The most important thing to remember about financial advice for single mothers is that it doesn’t have to be one-size-fits-all. Your money situation may not be exactly the same as every other single mom’s. And that’s fine.

What matters most is how you take the financial tips for single moms you’re collecting and apply them to your life.

In other words, figure out what works best for you. Then do that.

If you’re ready to stop being a financially struggling single mom, here are nine ways to do it.

1. Rethink your money mindset

Financial tips for single mothers usually start with making a budget. But it’s more important to first consider your mindset toward money.

Your mindset matters because it can influence what you do with your money.

For example, if you think you’ll always be broke then you might feel zero motivation to change your single mom financial situation. But if you tell yourself that you can get out of debt and build wealth, it’s a lot easier to take action.

So, first things first, spend some time addressing your money fears and any negative self-talk that might be keeping you stuck in the same place. You can go one step further and create some positive financial affirmations as you begin your money journey.

2. Budget and spend intentionally

Making a budget tops the list of financial tips for single mothers because it’s so much harder to get ahead without one.

A budget is simply a plan for spending money each month. There are different ways to make a budget, including:

- Dave Ramsey budget percentages

- 70/20/10 budget method

- Budgeting by paycheck

- Zero-based budgeting

You can also use a free tool like Empower to track your spending and monthly budget.

Part of budgeting as a single mom means learning how to live below your means. And that includes spending intentionally.

Before buying something you don’t need, ask yourself this:

Is this worth the effort I had to put in to make the money I’m about to spend?

Most of the time, the answer is going to be no. Once you start assigning a value to your time, it gets a lot easier to avoid wasteful spending.

But sometimes the answer is yes. And when it is, you’ll feel better about spending the money because you’ve already thought the purchase through.

Pro tip: Consider doing a no-spend challenge to cut out the extras in your budget.

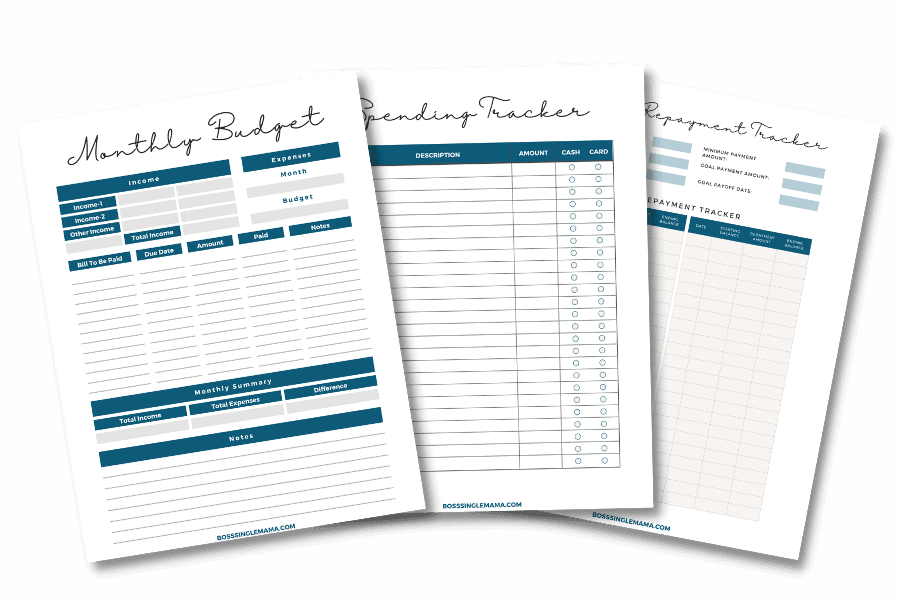

Get Your Budget on Track

Grab these free printable budget templates to take control of your money!

3. Save money automatically

Having savings is a great feeling, especially when you need money for something unexpected. Instead of freaking out and panicking, you can just pay for it and keep going.

So how do you save money as a single mom when you’re living paycheck to paycheck or you feel overwhelmed by bills?

First, you go back to your single mom budget to review your expenses. Then, you look at everything you spend for the month and start putting intentional thinking to work.

Challenge yourself to find $50 a month to save, $25, or whatever you can siphon off from your spending.

Commit to putting that amount in a savings account every month. This is your emergency, just-in-case money.

Looking for the best high yield savings option? Compare savings account rates online at top banks and credit unions now!

Every month, go over your budget again to look for more money you can save.

And if you’re having trouble getting into the savings habit, consider using a money-saving app like Acorns.

With Acorns, you’re investing your spare change instead of just saving it. Basically, you can grow an investment portfolio with literal pennies.

You create your Acorns account, then link it to your bank account. When you spend, Acorns rounds up the transaction and invests the difference.

Start saving with Acorns and get $5 free!

4. Set clear financial goals

Setting goals is one of the most impactful financial tips for single mothers, especially if you’re struggling with your mindset. Having a clear goal can be a huge motivator to manage your finances more responsibly.

For example, you might have debt you want to pay off. But you’re not making much progress with it.

That’s where goals come in.

You could set a big goal, like paying off $5,000 or $10,000 in a year. Then you figure out what you need to do each month to make it happen.

If setting big goals seems intimidating, it’s okay to start small. But don’t limit yourself mentally or be afraid to dream bigger.

And once you identify your goals, check in with them regularly to see what kind of progress you’re making. Reviewing your budget and goals once a month, for example, is a great opportunity to make any adjustments to your financial plan in order to stay on track.

5. Let go of past money mistakes

We’ve all made bad choices with our money at some point, whether it’s racking up debt, lending money to the wrong person or being wasteful with spending. If you’ve screwed up somewhere with money don’t let it paralyze you from learning how to manage your finances differently.

You may not be able to go back and erase the money mistakes you’ve made. But you don’t have to repeat them either.

Instead, you can:

- Believe that you can improve your financial situation going forward.

- Be confident about the choices you’re making now.

- Get educated about the things you don’t know about money.

And when you think about the missteps you made with your finances in the past, take them for what they are: life lessons.

Forgive yourself if you have to but make moving on from past money mistakes a priority as you learn how to manage your finances.

6. Ditch debt

Debt can be a major roadblock to achieving your financial goals as a single mom. So if you’re not prioritizing paying it off yet, it’s time to come up with a rock-solid debt repayment plan.

There are different ways to pay down debt as a single mom. You could try the debt snowball, for instance, or the debt avalanche.

How you go about paying off debt doesn’t matter as much as committing to your plan. Consistency is the most important part of becoming debt-free.

You can also do yourself a favor by making your debt less expensive.

Reducing your interest rates with a debt consolidation loan, for example, could help you to save money and get out of debt faster. You could also apply for a 0% balance transfer credit card.

Check out balance transfer offers and review your credit score at Credit Karma.

7. Start investing

Investing is one of the best ways to build wealth as a single mom and achieve financial independence.

When you invest money, you can build wealth as it grows over time. This is different from just saving money in a high-yield savings account.

If you’ve never invested money before, it’s not hard at all to get started.

You can buy your first stocks or exchange-traded with funds through M1 Finance for as little as $100.

The sooner you start investing, even if it’s only small amounts, the sooner you can start building wealth and financial independence.

Start investing with M1 Finance today!

8. Increase your income

This is one of the most important financial tips for single mothers if you’re sick and tired of feeling like you never have any money.

If you want to manage your finances well, you can’t buy into the idea that being a single mom means you have to be broke all the time.

Here’s what you do instead: You work on growing your income.

Now how do you do that?

Well, it depends on where you are right now.

It might be asking for a raise at work so your paychecks reflect the effort you’re putting in and what you’re worth.

Or it might be looking for a better-paying job in your field or going back to school.

Maybe you could start a side hustle or a home business to make more money. If you need some inspiration, check out these posts:

- 60+ Online Business Ideas You Can Start Right Now

- 25 Profitable Side Hustles That Are Perfect for Single Moms

- 10 Flexible Side Hustles for Women That Pay Well

- 30+ Ways to Make $1000 a Month Online (or Off)

- 25 High-Paying Stay-at-Home Jobs for Moms

Of course, you could also try starting a blog.

Blogging is lots of fun (and sometimes, a lot of frustration). It can also be a great way to make money online.

You can make money blogging by:

- Selling digital or physical products

- Including ads on your blog

- Writing sponsored posts

- Offering a service as part of your blog (like freelance writing or VA services)

- Marketing affiliate products

There are lots of possibilities for moms. You could start a mommy blog about single mom life or write about something totally different. It all comes down to what you’re interested in and passionate about.

So definitely give blogging some thought if you’re looking for a way to make money.

Ready to start a blog or website? It’s easy to get started with a custom domain and hosting through Siteground. Plans are affordable, which is perfect for beginners!

And even if you decide blogging isn’t for you, there are still lots of other things you can do to boost your earning potential.

Bottom line, if you’re not making as much money as you want to be, then find a way to change that.

9. Protect yourself and your kids financially

One of the scariest parts of being a single mom is worrying about whether your kids would be taken care of if something were to happen to you. Unfortunately, one of the most overlooked financial tips for single mothers is to buy life insurance.

Why do single moms need life insurance?

It’s simple. Life insurance can ensure that your kids are taken care of financially if the worst happens.

The younger you are and the healthier you are when you buy life insurance, the cheaper it usually is. But regardless of how old you are, life insurance is definitely something to think about, especially if you have younger kids.

If you’re ready to buy a policy, you can get free life insurance quotes through Haven Life.

They offer affordable term life insurance coverage for single moms or anyone else who wants to protect themselves and their loved ones.

While you’re looking into life insurance also think about making a will.

A will lets you choose who should get your assets after you pass away. You can also use a will to name a guardian for minor children.

Creating a simple will is something you can do online and it doesn’t cost a lot of money.

I recommend using Trust & Will if you’re ready to create a single mom estate plan. You can create a will quickly and easily so you have almost instant peace of mind.

Financial Assistance for Single Mothers

If you’re really struggling, then you may need more than just a list of financial tips for single mothers to get ahead.

For example, you might need help with:

- Affording housing as a single mom

- Paying utility bills

- Buying groceries

- Purchasing a home as a single mom

- Paying for college

Fortunately, there are lots of ways to find financial assistance for single moms, including state government agencies, federal agencies, nonprofits and local churches.

- Financial assistance for single moms (Master list of places to get help)

- Smart money tools for moms

- Single mom stimulus grant giveaway

They can help you get back on track financially if you’re struggling with money.

Final thoughts on the best financial tips for single mothers

Money can be a major source of stress for single parents, but it doesn’t have to be. By implementing these financial tips for single mothers it’s possible to remake your money situation.

It can take time to do, of course. But if you’re committed to creating a better life for yourself and your kids, it’s almost impossible not to see some kind of improvement. The sooner you start putting these financial tips for single moms to work, the sooner you can get on the path to money freedom.

Need more money tips? Read these posts next:

- Free At Home Jobs for Moms: 25 Legitimate Remote Work Options

- 10 Smart Money Tips for Families Living on One Income

- 31 Genius Hacks for How to Live Frugally on One Income

- 55 Things to Stop Buying to Save Money

- Living on a Tight Budget? 15 Simple Ways to Save Money