Single parents in general, and single moms in particular, face some unique financial challenges and struggles.

For example, you may be paying down debt while trying to manage everyday expenses as a one-income household. And raising kids isn’t cheap either. The typical family spends $233,610 to raise a child which rises to $286,000 when indexed for inflation.

Creating a single mom budget can help you get control over your money when personal finance seems overwhelming.

When you commit to making a monthly budget, it becomes easier to keep up with household bills, add money to savings and even build wealth as a single mother. Today, I’m sharing my best tips for creating a foolproof single mom budget.

LIKE FREE MONEY?

Here are some of my go-to apps for earning extra cash!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid, no special skills or experience required!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

Benefits of Creating a Single Mom Budget

A budget is a plan for how you’ll spend your money each month. When you have a budget, you have a blueprint for where your money is going to go.

Budgeting is especially important for single moms who may be raising a family on one low income.

While many single moms receive child support (and in some cases, alimony) those payments may only go so far. And from experience, I know that child support is not always a reliable source of income for single mothers.

Having a single mom budget in place can take some of the pressure off of managing your finances solo.

Some of the things a budget can do for you include:

- Helping you to avoid overspending and wasting money on unnecessary things

- Breaking the paycheck-to-paycheck cycle

- Finding extra money to save each month

- Giving you a realistic plan for paying off debt

I can’t stress the importance of budgeting for single moms enough. With the right budget plan, you can significantly improve your finances and life.

And most importantly, you can stop the struggle for how to survive financially as a single mom.

9 Smart Tips for Budgeting as a Single Parent

Budgeting for single parents isn’t always easy. But it is doable if you’re committed to your spending plan.

Here are 9 tips for creating a single mom budget that you can live with.

1. Prioritize emergency savings

Saving money as a single mom can feel impossible at times but it’s important to have an emergency fund.

Your emergency fund is your lifeline when an unexpected expense comes along. Roughly a third of Americans couldn’t cover a $400 emergency in cash and as a single mom, you don’t want to be one of them.

If you have $0 in emergency savings, set a goal of saving $1,000 to start.

Having this money in the bank can provide some peace of mind in case an unexpected expense comes along. Once you reach the $1,000 savings threshold, you can increase your savings goal.

It’s better if you can save the $1,000 in 30 days or less. But if you can only save $25 a week or $10 per pay period, the most important thing is that you get started and you keep saving regularly.

Remember to choose the right bank for your savings. An online bank can offer high-yield savings accounts with minimal fees.

Looking for the best high yield savings option? Compare savings account rates online at top banks and credit unions now!

2. Streamline expenses for yourself and your children

Keeping expenses for yourself and your kids as low as possible is the best way to stretch your income as a single mom. When you’re making a single mom budget, consider your wants vs. needs.

“Needs” take first priority for budgeting as a single mom. So that includes things like housing, utilities, food and transportation.

If you’re a newly single mom, you may be paying for necessary expenses that you weren’t before, like health insurance or child care so you can work. If so, you’ll need to add those to the “needs” section of your single mom budget.

“Wants” are anything you and your kids can live without.

So that means new clothes, entertainment, toys and books. The more you can trim down your budget, the better, especially if you’re living on a low income to start.

Here are a few things I did as a newly single mom to reduce my expenses:

- Planning out meals and sticking to a strict $75 a week grocery budget (mind you, this was in 2014 when inflation wasn’t sending grocery prices sky-high)

- Looking for fun things to do with my kids that were 100% free

- Clipping coupons for any and everything (I still do this to save money)

- Buying used instead of new and only when we absolutely needed something

- Swapping cable for Hulu and Amazon Prime instead

- Getting a prepaid cell phone, which saved me about $60 a month

Remember, every penny you can cut from your single mom budget is a penny you can save or use to pay down debt.

3. Decide whether to include child support in your budget

If you receive child support as a single parent, you’ll need to decide whether to include that money in your monthly budget or not.

(Personally, I never included child support in my budget because the payments were unreliable. Had I included child support in my single mom budget, I might have had to rework my spending plan once that money eventually stopped coming.)

If you’re confident that child support will be consistent, then you can treat it as an additional source of income in your budget. You might earmark the money for things like child care, extracurricular activities for your kids, clothes and shoes or other things your children need.

And if child support is sporadic, you can treat this as “extra” money in your budget. When it comes in you can use it to treat yourself and the kids to something fun or put it toward one of your family’s financial goals.

4. Track expenses monthly

Budgeting for single parents isn’t a once-and-done thing. You’ll want to review your budget each month and adjust it as needed when your expenses or income change.

Tracking expenses from month to month can give you a better idea of what you’re spending and where.

Some of the ways you can track expenses include:

- Using a free budgeting app like Mint or Personal Capital

- Writing expenses down in a notebook

- Use a simple expense tracking spreadsheet

- Trying the cash envelope budget method

It doesn’t matter which system you use. What’s important is making sure you know where your money goes every month.

If you’ve never tried to make a single mom budget before, then I suggest tracking your expenses for one full month to get a sense of how you spend. From there, you can work on cutting out expenses your family doesn’t really need.

Looking for a simple money management tool? Empower makes it easy to track spending, saving, investing, and budgeting in one place so you can tackle your financial goals!

5. Get rid of high-interest debt

Credit cards, loans and other high-interest debt can put a strain on your finances as a single parent. So paying off debts as quickly as possible is a great way to free up more money for other things.

If you have multiple credit cards and a limited income, you might try the debt snowball method for paying it off.

The debt snowball method was popularized by Dave Ramsey. Here’s how it works:

- Order debts from lowest balance to highest

- Pay as much as you can to the smallest debt on the list

- Make only minimum payments to other debts

- Once you pay off the smallest debt, roll its payment over to the next debt on the list

- Rinse and repeat

This may not be the fastest way to pay off debt and it may not save you money on interest. But it can get you out of debt if you’re consistent.

And you can also use a tool like Bright Money to accelerate debt repayment. Bright Money helps you get out of debt faster by reducing interest charges on credit cards.

6. Plan for long-term financial goals

Saving money for an emergency fund is a good place to start. But it’s also important to include longer-term goals in your single-parent budget.

For example, your financial goals might include:

- Buying a home

- Purchasing a new vehicle

- Saving for retirement

- Setting aside money to pay for your kids’ education

You may also want to create sinking funds for occasional expenses, like insurance premiums or pet care.

If you have multiple financial goals but you can’t work on them all at the same time, you’ll need to prioritize which ones are most important.

For example, I opened an IRA to save for retirement two years before I started saving for a house. After I purchased my home, I shifted the money I was saving for a down payment into savings accounts for my kids.

If you’re not sure which financial goal to go after first, talking to a financial advisor could help. There are lots of financial advisors who offer a free consultation to help you get on track.

7. Get a month ahead on bills

Trying to make a single mom budget work can feel a lot like being a hamster on a nonstop wheel if you’re constantly struggling to stay on top of bills. And just when you get one paid, it seems like the next one is due.

Getting bills paid up a month ahead can help relieve some of the pressure to make your single parent budget work and not feel overstretched.

One smart way to get ahead financially is to use windfalls to pay bills in advance.

For example, the average taxpayer gets a $3,000 refund each year from the IRS. That’s essentially free money that you could use to get ahead on monthly bills.

The same trick works with other unexpected amounts of money that might come your way. For example, you might get a bonus at work or receive a rebate in the mail that you forgot about.

That’s all money that could help you get ahead on bills as a single parent.

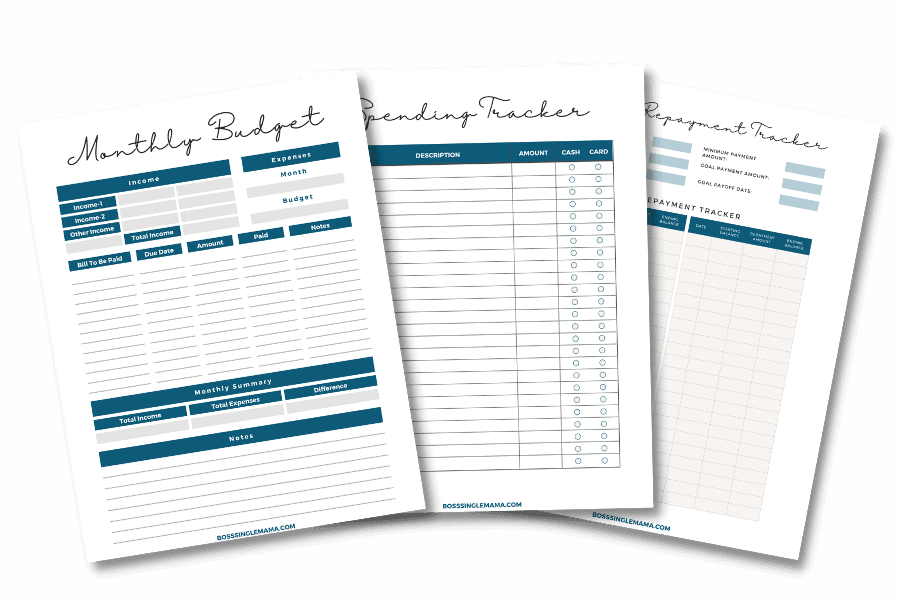

Get Your Budget on Track

Grab these free printable budget templates to take control of your money!

8. Challenge yourself to save more money

Saving money is one of the best things you can do for yourself and your kids as a single mom. Trying a money-saving challenge can help you find the motivation to save.

One of the simplest money-saving challenges you can try is a no-spend challenge. You commit to not spending money unnecessarily for a set period of time and what you don’t spend, you save instead.

Other challenges you could try include:

- 52-week savings challenge

- Penny savings challenges

- 100 envelope challenge

- 200 envelope challenge

- Saving all your spare change

- $5 bill savings challenge

The great thing about money saving challenges is that you can get your kids involved. For example, with the spare change challenge, you can take turns dumping change in and then counting it out together.

It’s a fun and simple way to get kids interested in the idea of saving money. Plus, you might be surprised at just how much you can save as a family by trying a money challenge.

9. Increase your income

As a single mom, your income sources might include:

- Full-time employment

- A part-time job

- Child support

- Alimony

- Government assistance and other financial help for single moms

- Financial help from parents or grandparents

Regardless of where your money comes from each month, the single best way to make a single mom budget work is to increase your income.

Here are some of the best ways to make extra money as a single mom:

- Sell your clutter

- Get paid to lose weight

- Become a virtual assistant

- Earn extra cash taking surveys

- Use cash back apps like Swagbucks, Ibotta and Rakuten to save when you shop

- Learn how to proofread or transcribe for money

- Get money back when eating out with the Dosh app

- Get paid to pet sit or babysit

- Make money teaching online with Outschool

You can try some of these ideas or all of them. And of course, don’t overlook other ways to make more money.

For example, you could ask for a raise at work or take on more hours. And you might get a traditional part-time job or decide to go back to school to boost your earning potential.

Keep Your Single Mom Budget Simple

A budget is just a breakdown of what you spend versus what you earn for the month. When making a budget as a single mom, less is almost always more when it comes to the spending side.

As you work out what to include in your budget, try to keep it as pared-down as possible to start. Stick with the major budget categories that cover the expenses you and your kids need to live each month.

The goal is to make sure your most important expenses are covered first.

If you’ve assigned money in your budget to those expenses, then you can start adding in other things. For example, you could add in extracurricular activities or the occasional dinner out, depending on how much money you have to work with.

As your income grows, there’s one money trap you don’t want to fall into: lifestyle creep.

That means that as your income goes up, you spend more money. But keeping your money goals in sight can help you avoid overspending.

The more intentional you are with your money and budgeting as a single mom, the more solid a financial foundation you can build for your family. And at the end of the day, having financial security as a single parent is priceless.

Need more money tips? Read these posts next:

- 30 Inspired Gifts for Single Moms (Thoughtful, Fun and Practical!)

- 25 Lucrative Side Hustles for Single Moms Who Need to Make Money Now

- 33 Best Side Hustles for Women (Make Extra Money Now)

- Passive Income Ideas for Moms: 10 Legitimate Ways to Make Money Passively

- 50+ Flexible Side Hustles for Moms Who Want to Make Extra Money