Last Updated on July 7, 2023 by Rebecca Lake

When you have planned expenses you need to pay for or specific money goals you’re working toward, sinking funds can help you save for them.

A sinking fund holds money that you set aside for a specific purpose or expense. Sinking funds are separate savings accounts from emergency fund, which are designed to help you cover unexpected expenses.

Not sure what it all means? This guide to sinking funds for beginners breaks down how sinking funds work, what they’re used for, and tips for building savings.

LIKE FREE MONEY?

Here are some of my go-to apps for earning extra cash!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid, no special skills or experience required!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

Table of Contents

Sinking Funds for Beginners Definition

What does the term sinking fund mean? If you need a simple sinking funds definition, here it is.

A sinking fund is a fund that holds money you plan to spend at some future date.

The purpose of a sinking fund is to help you save toward your goals a little bit at a time on a regular basis. You might use a sinking fund to pay for a one-time purchase or expense, or to cover expenses that you pay quarterly, biannually, or annually.

That’s how sinking funds are used in personal finance. The accounting definition of a sinking fund is cash that’s reserved to pay off long-term debt, replace a wasting asset, or cover future expenses.

So why is it called sinking funds?

Sinking funds get their name because the balance goes down as you withdraw money for planned expenses.

The use of sinking funds was popular with the British government in the 1700s. On the advice of Robert Walpole, a sinking fund was established by Parliament in 1717 to help reduce the millions of pounds in debt that resulted from the British-French wars of the late 1600s.

Today, corporations, governments, schools, and other entities routinely use sinking funds to hold cash reserves. But sinking funds are also used by everyday people to manage personal finances.

Looking for a simple money management tool? Empower makes it easy to track spending, saving, investing, and budgeting in one place so you can tackle your financial goals!

How Sinking Funds Work

Sinking funds work by allowing you to save money regularly toward a planned expense. Once it’s time to pay for whatever you’ve been saving for, you can withdraw money from the sinking fund to pay for it.

A sinking fund may be created with a specific target date in mind if you’re saving for a one-time expense. For example, you might set up a sinking fund in December to save for a vacation you plan to take the following June.

You can also set up open-ended sinking funds to pay for expenses you pay periodically. This type of sinking fund may work best for expenses that aren’t included in your regular monthly budget.

Save More With Rocket Money

Stop overpaying and start saving!

Rocket Money is an all-in-one personal finance app that helps you find savings instantly, lower your bills, and keep more of your hard-earned cash.

It’s a simple way to build savings back into your budget every month, without getting nickel and dimed.

Examples of Sinking Funds for Beginners

There are lots of different expenses that you could use sinking funds to save for. Depending on what kind of expenses or savings goals you have, you might use a few sinking fund categories or a lot.

Here are some of the most common sinking fund examples:

- Home improvements or home repairs

- Home maintenance

- Homeowners insurance, HOA fees, or property taxes

- Moving expenses if you’re planning to relocate

- Vehicle maintenance (including new tires, oil changes, and other services)

- Car repairs

- Pet care and vet bills

- Back-to-school shopping and school supplies

- Field trips or fees for extracurricular activities

- Summer camp fees

- Holiday shopping and Christmas gifts

- Gifts (for birthdays or special occasions other than holidays)

- Vacation fund or other travel

- Wedding expenses

- Biannual or annual car insurance premiums

- New furniture

- New baby expenses

- Living expenses while you’re on maternity leave

- Self-employment taxes or other tax payments

- Health care expenses

- Any irregular expenses you have to pay that aren’t part of your monthly budget

- Down payment on your next car

- Down payment on a home

- Mortgage closing costs if you’re planning to buy a home

Those are just some examples of different sinking funds you might have. You can use sinking fund money to cover virtually any large expense (or small one).

A detailed example of a sinking fund

If you’re still not sure how to use a sinking fund or why you’d even need one, here’s a more detailed example.

Say that you’ve just gotten the news that a baby is on the way. You want to save $5,000 to cover new baby expenses and replace your income while on maternity leave. The baby is due in six months.

You decide to open a savings account to hold your new baby sinking fund and contribute $833 to it each month. Once the baby arrives, you stop adding to the account and start spending it down instead.

Pro tip: Any money that doesn’t get used in one sinking fund can be rolled over to another.

Sinking Fund vs. Savings Account

Is a sinking fund the same thing as a savings account? Yes and no.

Sinking funds can be held in a savings account while you’re working on setting aside money for your goals or expenses. A high-yield savings account is a great option because you can earn a competitive interest rate, with minimal fees.

A savings account is just that–an account to hold your savings. When you open a savings account, there may not be a specific goal attached to it. You might open the account just to hold extra money you don’t plan to spend so you can earn a little interest on it.

With a sinking fund, you’re saving more methodically and intentionally.

Going back to the new baby fund example, the sinking fund has a clear goal and an end date. You also have a set amount you need to save monthly to reach your savings goal.

Looking for the best high yield savings option? Compare savings account rates online at top banks and credit unions now!

Sinking Fund vs. Emergency Fund

What’s the difference between a sinking fund vs. emergency fund?

A sinking fund is for money that you save toward planned expenses. An emergency fund is designed to hold the money you save for an unplanned expense.

For example, say you get laid off from work. You could draw on your emergency fund to cover your basic living expenses until you find a new job.

Or say that your cat swallows part of a shoelace and needs life-saving surgery. You could tap your emergency savings to cover the vet bills.

Those are examples of true emergencies.

An emergency fund is a financial safety net that’s designed for ‘what-if’ scenarios. A sinking fund is meant to help you avoid having to scramble to come up with the money for planned expenses.

Keeping sinking funds and emergency funds separate is a smart idea. When you use your emergency fund to pay sinking fund expenses, you risk being low on cash when a true emergency comes along.

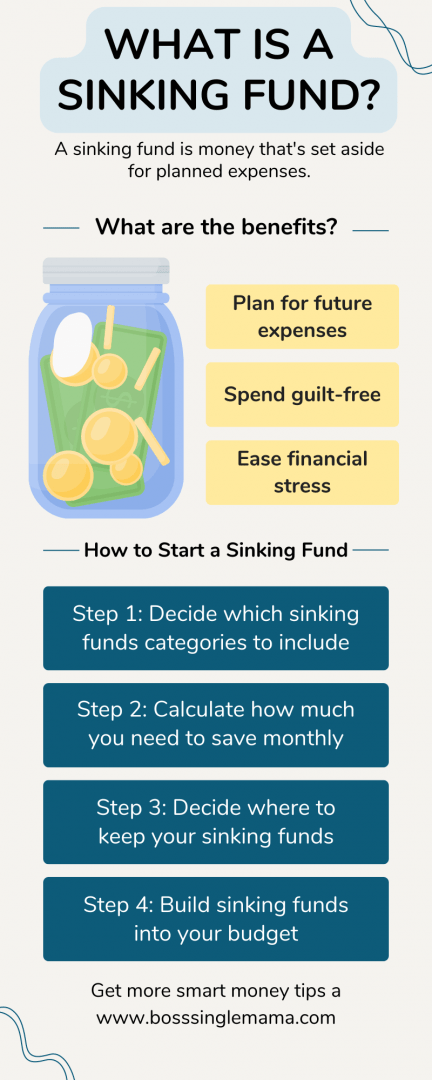

Benefits of Sinking Funds

One of the most important things to know about sinking funds for beginners is that they’re designed to help you, not make budgeting or saving more complicated.

Setting up sinking funds can benefit virtually anyone who wants to save toward specific expenses or goals in a disciplined, consistent way. Here are some of the best reasons to add sinking funds to your budgeting and money management strategy;

- Save for specific goals. Sinking funds allow you to fine-tune your financial goals and break a larger savings target into smaller savings buckets.

- Spend intentionally. A sinking fund makes it easier to spend money intentionally and guilt-free since you’re setting money aside for different expenses regularly.

- Save at your own pace. Sinking funds let you plan out your savings over time, so you can decide how much of your budget to allocate to each one, each month.

- Avoid debt. Using sinking funds to save and plan for expenses means you don’t have to resort to using a high-interest credit card to pay for them. That’s a plus if you already have credit card debt you’re trying to pay down.

- Stress less. Managing finances can be difficult enough. Sinking funds take the stress out of paying for future expenses since you’re saving for them on a defined schedule.

Saving with sinking funds means that you can enjoy the “fun” purchases or expenses you have coming up. And any recurring expenses are less likely to feel like a nuisance or a burden.

In a nutshell, sinking funds can give you peace of mind. When you have upcoming expenses to pay, you can save for them strategically instead of trying to make an educated guess about how to hold back from your budget.

You can pay for big expenses or small ones without affecting your cash flow or causing yourself unnecessary financial stress.

Sinking Funds for Beginners: How to Get Started

Starting a sinking fund (or sinking funds) isn’t difficult. This guide to sinking funds for beginners wouldn’t be complete without a step-by-step checklist for creating them.

1. Choose your sinking fund categories

The first step in creating a sinking fund is deciding what to save for.

So, again, you might start a new baby sinking fund or a home improvement sinking fund. Or you might set need a sinking fund for some big purchases you plan to make.

The great thing about sinking funds is that you control how many you have and what they’re used for. And as you reach your goals, you can set new ones and start all over with saving in a sinking fund.

2. Choose a savings goal amount

Once you know what your sinking fund is for, the next step is deciding how much to save.

For instance, if you’re saving money for Christmas presents, you might set a goal of $1,000. Or you might have a bigger goal of saving $10,000 toward a down payment on a new car.

You can go through and choose a dollar amount for each of your long term and short-term savings goals. And once you’ve done that, you can add them all up to see the total amount you’re saving.

3. Set a deadline for your goal

Sinking funds are usually time-bound, so you’ll want to go through each fund on your list and assign a deadline for reaching your goal. That can make it easier to figure out how much money to allocate toward each fund every pay period.

Let’s use saving $1,000 for holiday shopping as an example again.

If it’s 10 months until the start of the holiday shopping season, you’d need to save $100 a month. If it’s 5 months away, you’d need to save $200 a month instead.

You can also break it down by the number of weeks if you get paid weekly versus biweekly or monthly. And it’s easy to do this same calculation (overall savings goal ÷ the number of months to goal) to figure out how much to save monthly in each of your sinking funds.

4. Decide where to keep your sinking funds

There are some different accounts you might use to hold your sinking funds. The most important rule of thumb to remember is that your sinking funds should be accessible so that you can use them when you need them.

And it’s also good to have a separate account from your main spending account. That can keep you from dipping into your savings accidentally.

Here are a few options for managing sinking funds

Free checking account

A free checking account at a bank or credit union is a convenient option for sinking funds.

Your account might come with paper checks, a debit card, or both. That could make it easy to spend your sinking funds on a large purchase or use them to pay bills when the time comes.

Free checking accounts usually mean no monthly maintenance fee, but other fees might apply. If you’re shopping for a free checking account, check to see if you’ll be able to earn any interest on your balances.

Traditional savings account

Traditional savings accounts pay you a little bit of interest on deposits. You can find these accounts offered at brick-and-mortar banks or credit unions.

In terms of the interest you can earn with traditional savings accounts, rates usually aren’t that great. And many traditional banks charge fees for savings accounts.

For those reasons, you might be better off checking out the next option on the list.

High yield bank account

High yield bank accounts, including high yield savings accounts and high yield checking accounts, pay competitive rates on balances. Many of the best high yield accounts have no monthly maintenance fees either.

A high yield account at an online financial institution could be a good choice if you want to earn the best interest rate possible on sinking funds.

They’re a great way to save, even if you’re only depositing a small amount of money thanks to how much interest you can earn. And when it comes to fees, the total cost of high yield accounts at online banks is usually much lower than traditional bank accounts.

Money market account

Money market accounts combine features of checking accounts with savings accounts.

You can earn interest on balances but you might also get a debit card or checks. In other words, it’s the best of both worlds. This is a great option if you have larger annual expenses to pay.

For example, I use a money market account as a sinking fund to pay my estimated taxes and annual income taxes. I deposit money each month, then pay estimated taxes quarterly.

At the end of the year, I deposit any additional funds needed to pay my income taxes if I owe. Then I pay it all in a lump sum directly from my money market account. It’s a simple savings system that always ensures I have enough money to cover my taxes (and stay on the IRS’s good side).

If you’re self-employed or make money with side hustles, you might set up your own sinking fund for taxes.

Grow Savings Faster With Current

Current is a digital banking app that makes it easy to grow savings, manage spending and track your goals in one place! You can set up individual savings pods for different goals and earn the same competitive APY for each one.

Aside from making saving a breeze, Current also comes with other great features like fee-free overdraft and access to 40,000+ ATMs!

**View product disclosures

Cash envelopes

You could also cash envelopes to store your funds. That’s convenient if you normally budget using the cash envelope system.

Of course, the drawback is that you’ll miss out on earning any interest. And depositing your savings in an FDIC-member financial institution is safer than keeping large amounts of cash around the house.

If you’re looking for some cash envelopes to get started, be sure to check out the cute options in the Boss Single Mama shop!

5. Add sinking fund categories to your budget

If you’ve established your sinking funds categories, the next step is to add those amounts to your monthly budget. That way, you don’t have to worry about shortchanging any of your funds.

So here’s another example of what that might look like in your budget.

- $100/month for Christmas and holidays

- $100/month for car insurance premiums

- $100/month for home improvements and repairs

- $200/month for vacation

- $400/month for new baby expenses

That’s $900 per month you’d need to budget for sinking funds, in addition to whatever you’re already budgeting for regular monthly expenses or debt repayment.

How much money you should keep in a sinking fund will depend on your goals. The more sinking funds you have and the higher your savings targets, the more you’ll need to save each month.

6. Set up an automatic transfer to sinking funds

Last but not least, you can automate deposits or transfers to your sinking fund bank accounts.

Automating ensures that you don’t forget to save or skip a monthly contribution. And it’s easy to automate your savings to sinking funds when you link those accounts to checking.

Make Quick Cash With Survey Junkie

Take surveys. Earn rewards. Get paid.

Making extra money is that easy when you create an account with Survey Junkie. It’s free to sign up and you can earn real cash in your PayPal account or free gift cards, just for answering questions and sharing your opinions.

Sinking Funds for Beginners FAQs

How many sinking funds do you need?

There is no exact number of sinking funds you need to have. Some people may have just one or two while others have 10 or more. The right number of sinking funds for you will depend on how many expenses you’re saving for.

Do you need sinking funds and an emergency fund?

It’s a good idea to have both sinking funds and an emergency fund. Sinking funds can be used to cover expenses you anticipate, while an emergency fund is designed to help you handle any major expenses or unexpected costs you weren’t counting on having to pay.

What are the best accounts for sinking funds?

The best place to keep sinking funds is a liquid savings account that offers convenient access and a high interest rate. Online banks can offer competitive APYs for savers and you can easily link them to accounts at a brick-and-mortar bank.

How to track sinking funds for beginners?

The easiest way to manage sinking funds is using a printable sinking funds tracker. You could also track sinking funds online using a budgeting app. My favorite budgeting app is Empower, which makes it easy to budget, save, spend, and invest in one place.

How much money should be in a sinking fund?

The amount of money you keep in a sinking fund will depend on how much you need to save for that fund’s purpose or goal. You can use a sinking fund calculator to determine how much you’ll need to set aside each month for your goal.

Get Your Budget on Track

Grab these free printable budget templates to take control of your money!

Final Thoughts on Sinking Funds for Beginners

Using sinking funds can help you to get ahead financially if you’re planning ahead for expenses in advance. As this guide to sinking funds for beginners shows, getting started isn’t complicated at all. And in the long run, getting into a regular savings habit is good for your overall financial health.

Need more money tips? Read these posts next:

- 90+ Cash Envelope Categories to Help You Budget More Effectively

- Dave Ramsey Budget Percentages Explained

- Single Mom Budget Guide (9 Smart Budgeting Tips for Single Mothers)

- How to Do a No Spend Challenge (3 Pro Tips to Help You Save Money)

- Save Money Live Better (20 Easy Ways Save More This Year)