Is saving more money one of your financial goals?

More than half of Americans say they’re uneasy with the amount of money they have in savings, according to a Bankrate survey. The good news is that if you don’t have as much saved as you’d like, there’s a simple way to save more.

The 52-week money challenge (also known as the 52-week savings challenge) can help you get into the habit of saving money regularly. This personal financial challenge is designed to get you to start saving money on a weekly basis so you can end the year richer than when you started.

Developing a savings plan can help you get one step closer to good financial health. And it’s possible to save even on a tight budget if you’re committed to setting aside a certain amount of your income every payday.

Ready to start the 52-week money challenge and get your savings goals on track? Keep reading to learn how to use this money challenge to take control of your finances.

Related post: Penny Savings Challenge Explained (Save $667.95 This Year the Easy Way!)

LIKE FREE MONEY?

Here are some of my go-to apps for earning extra cash!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid, no special skills or experience required!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

What Is the 52 Week Money Challenge?

The 52 week money challenge is a savings challenge that helps you to save small amounts of money by making a regular weekly deposit for an entire year.

In week 1, you deposit $1 into your bank account. Then in week 2, you deposit $2, followed by $3 in week 3, $4 in week 4 and so on.

At week 52, you deposit $52 into your bank account to complete the challenge. So you’ll have 52 weeks’ worth of savings at the end of the year.

The 52-week money challenge can be a great way to save and get into a regular habit of budgeting. In fact, it may be the best method to save if you don’t have a lot of extra dollars to spare after paying bills each month.

By setting aside money in smaller amounts every week, you can build a regular savings habit over time. You can use the 52 week money challenge along with other saving money challenges to build a starter emergency fund or set aside cash for another short-term savings goal.

Related post: No Spend Challenge: 10 Simple Tips to Help You Save More Money Now

How Does the 52 Week Money Challenge Work?

The 52 week challenge works by having you save money for 52 weeks. Every week, you deposit a predetermined amount of money into an account designated just for that goal.

You can start with week one at the very beginning of the year in January if your new year’s resolution is to save more money. But you can really take this savings challenge at any time.

So again, here’s what your weekly savings amounts might look like if you start with just $1:

- In the first week of the challenge, you save $1

- In the second week, you save $2

- In the third week, you save $3

- The next week, you save $4

You keep on going this way, increasing your savings amount by an extra dollar each week. The number of the week corresponds to that week’s savings amount.

So by the time you reach the end of the 52 weeks, you’re saving $52 a week.

This type of 52-week money challenge follows the low to high method, in that you’re saving the smallest amount of money in the first week and a larger amount by the final week. But there are countless versions of the challenge you can try.

Related post: 100 Envelope Challenge Explained (Free Printable Chart!)

Reverse 52 week savings challenge

The reverse 52 week money challenge works backward, with you saving $52 in week one, then saving gradually smaller amounts each week through the end of the year.

You’d still save on a regular basis over the full 52-week period. But you’d be saving more in the beginning of the year and less each week around the holiday season.

This is one of the best ways to approach the 52 week money challenge if you’d rather save a lot in the first month and less as time goes by.

Related post: 200 Envelope Challenge (Save $5,100 in 200 Days!)

How much money do you save in the 52 week financial challenge?

The 52 week money challenge is designed to help you save a total amount of $1,378 in a year.

That’s how much you should have at the end of week 52 if you start with $1 (or $52 if you’re doing a reverse savings challenge). If you start your savings challenge in the first week of the year, then you could have a decent chunk of change to help pay for Christmas.

Of course, you can always tweak the challenge to fit your budget.

So if you can’t start with $1 the first week, you could try for $0.50 instead. I know that doesn’t seem like much but it’s better than saving nothing at all, especially if you can add to it over time.

Or you could supersize your savings efforts if you want to save even more.

For example, say you start off saving $5 a week instead. You add $5 to your savings total each week for the first 26 weeks.

By the halfway point of the year, you’d be saving $125 a week. If you kept that up for the rest of the year, you’d have $5,000 in savings at the end of the challenge!

The 52-week money challenge isn’t so much about how much you save. It’s more about getting into the savings habit.

How to Save With the 52 Week Money Challenge

Ready to give the 52 week money challenge a try? These tips can help you finish up the challenge with more money in your bank account.

1. Decide when to start the challenge

If you’re interested in how to save money each week, the first step is deciding when to begin.

For example, the first week of the year or the first month are popular times to begin a yearly savings challenge.

This is when a lot of people are coming off a holiday spending rush and they’re ready to hit the reset button on their finances. So your new year’s resolution might be saving money and putting the brakes on wasteful spending.

But again, you could start a 52-week money challenge at any time to improve your financial health.

Regardless of when you decide to start your money-saving challenge, the most important thing is committing to it.

2. Build savings into your budget

A budget is one of the simplest and most important financial tools you can have.

When you have a budget in place, it’s so much easier to save money because you can plan for it.

If you don’t have a budget yet, read through this guide to budgeting first. Then, look at your expenses to figure out where you can cut back so you have more money to fund your savings goals.

The more expenses you can reduce or eliminate, the more cash you’ll have for saving. If you need an easy way to cut back on spending, Trim can help.

Trim is a financial assistant and app that reviews your expenses to find money that’s going to waste.

For example, you might be paying for streaming services you’re not using or overpaying bank fees. If you need help finding the money to save for the 52-week challenge, give Trim a try.

3. Automate your weekly savings deposits

Automating is one of the easiest ways to simplify your financial life.

Going the automated route with the 52 week money challenge means you don’t have to worry about missing a week of savings.

You can simply link your checking account to your designated savings account, then schedule a recurring weekly deposit. The amount you save in week 1, week 2, week 3 and so on gets deposited into your savings account automatically.

Automating works for this challenge and it can also help you build savings for other goals, like retirement.

But if you can’t or don’t want to set up automatic transfers, here’s something else you can do: Set up weekly notifications in your calendar instead.

Getting a weekly text message or email can help you stay accountable to the 52 week money challenge. When you set reminders, it’s harder to forget to make a deposit or transfer money to savings.

Setting reminders or alerts is something you should be able to do through online banking if your financial institution offers it. And creating bill payment alerts can also help you stay on top of bills so you don’t risk late payments and credit score damage.

Related post: Behind on Bills? 10 Things You Can Do Now to Get Caught Up

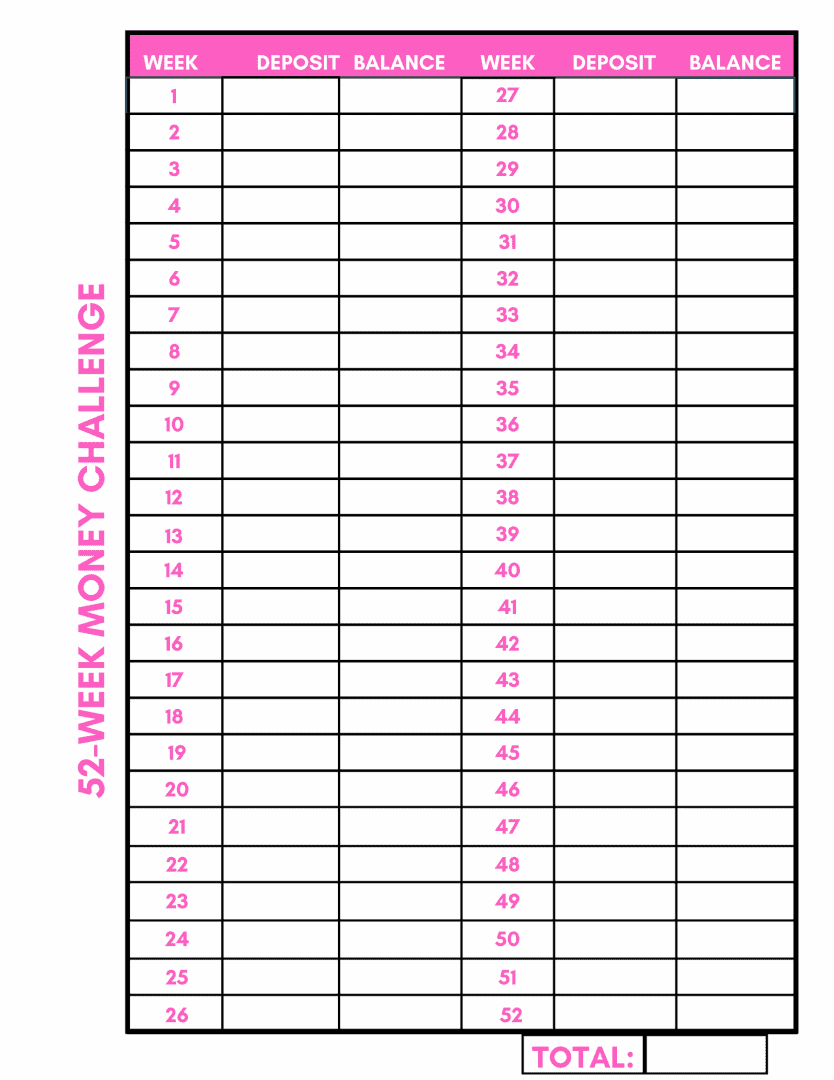

Free printable 52 week money saving challenge chart

Having a chart to keep track of your savings progress can be a good idea if you need a little visual motivation.

I’ve got a free printable 52 week savings challenge chart you can download. Just click the image and you’ll be taken to the Resource Library where you can sign up to access lots of free money printables!

How to Find Money to Save for a 52 Week Challenge

The 52 week money challenge can be a great motivator to increase your savings balance and improve your financial life.

Again, budgeting is an important step in finding extra cash to save weekly. Getting the whole family on board with budgeting matters for trimming expenses so you can get ahead financially.

Paying down debt is also important. If you have credit card debt, student loans or other debt, all of that can be a barrier to saving, no matter how much you’re able to reduce other expenses.

Prioritizing debt repayment can help you gain control of your finances and make reaching your financial goals realistic. If you owe money to credit cards or other high interest debt, consider ways to make it less expensive, such as refinancing or consolidating bills.

You can also look for other ways to increase your saving amount by getting creative with how you manage your finances.

Here are a few tips you can try:

- Deposit your tax refund to savings

- Apply holiday bonuses to savings

- Using free money hacks to get bonus cash

- Save a cash gift you receive instead of spending it

- Grow your savings with rebates

- Sell things you don’t need and save the extra money

- Stop buying frivolous items that are just draining your budget and save the money instead

You could also make extra money to save with side hustles or cashback apps.

Make extra money with side hustles

Starting a side hustle was how I eventually ended up running a six-figure business from home.

What’s great about side hustles is that there are so many ways to make money!

Some of my favorite ideas for making cash on the side include:

- Starting a virtual assistant business

- Getting paid to proofread

- Online transcription jobs

- Teaching kids online

- Getting paid to lose weight

- Investing your spare change

And if you need more ideas here are 50+ ways to make an extra $1000 a month!

Use cashback apps to make extra money

The 52-week money challenge isn’t the same as a no-spend challenge, which is designed to help you curb impulse spending. It assumes that you will spend money along the way as you’re saving.

But you can get back some of what you spend with cashback apps. These apps pay you back a percentage of what you spend.

There are lots of different cash-back apps out there but some are better than others. Here are some of my go-to picks for earning cashback.

Rakuten

Rakuten lets you shop and earn cash back at more than 2,500 partner retailers.

All you do is create your Rakuten account, shop partner stores and earn cashback. You get paid via check or PayPal–it’s really that simple!

Aside from cashback, Rakuten also offers special promotions and discount codes. It’s an easy way to double up on savings.

👉 Join Rakuten now and get a $10 bonus!

Ibotta

The Ibotta app is a must-have for saving money on groceries and shopping.

With Ibotta, you can link your store loyalty cards to the app. When you shop, you can earn cashback instantly at partner stores. Or, you can scan your receipts after you shop to earn cash rewards.

Either way, you can rack up more cash to put toward savings.

As a bonus, Ibotta also works with Instacart. So if you’d rather let someone else do your grocery shopping for you, you can still score cash rewards!

👉Download the Ibotta app and get up to $20 in bonuses!

Dosh

The Dosh app is another must-have app for earning cash back and saving money.

This app pays you cashback on shopping, but you can also earn cash rewards at restaurants and on travel.

If you’re already using Ibotta and Rakuten to save at grocery stores and retail stores, the Dosh app can round out a perfect trifecta for earning cash rewards.

👉Get the Dosh app and start earning cashback now!

Where to Keep the Money You Save With a 52-Week Challenge

Consider the best place to keep the money you’re saving each week for the challenge.

You could stash it in a simple piggy bank but keeping it in a separate savings account is a smarter choice.

For one thing, your money is safer in an FDIC-insured savings account. And for another, you can earn interest on what you’re saving to help grow your money faster.

A high yield online savings account or money market account can your best bet for getting a great interest rate on savings. Online banks almost always pay higher rates than big banks or a credit union and they tend to charge fewer fees, too.

If you’re looking for a high-yield savings account recommendation, check out CIT Bank and UFG Direct.

They both offer competitive APYs on savings and money market accounts, without high fees.

Looking for the best high yield savings option? Compare savings account rates online at top banks and credit unions now!

FAQs

How can I save $5000 with the 52 week money challenge?

If you’d like to save $5,000 with the 52 week money challenge you’d need to save $96.15 per week on average. You could, however, start with a lower savings target and work your way up. For example, you could save $20 the first week, $35 the second week, $45 the third week and so on until you hit your $5000 savings goal.

How do you save $10000 in 52 weeks?

Want to complete a 10k money challenge instead? A $5,000 goal for the 52 week savings plan doubled to $10,000 requires a little more work but it’s possible to achieve. If you’d like to save $10000 in 52 weeks you’ll need to save an average of $190.31 per week. Finding an extra $200 a week to save starts with reviewing your budget. You may be able to cut expenses so you have more to save but if not, you might want to consider starting a side hustle, selling things to make money or getting a part-time job to generate extra cash.

Does the 52 week money challenge work?

The 52 week savings challenge can work if you’re committed to sticking to your savings plan. If you save as scheduled for all 52 weeks you should end the year with an extra $1,378 in savings. The 52 week money challenge may not work for you, however, if you’re not serious about saving money regularly.

Final thoughts on the 52-week money challenge

Taking a savings challenge for a whole year can be a great way to get into the habit of saving. You might use it to save for a short-term goal like emergency savings or a long-term goal like building a down payment on a home or paying cash for a new car. And having an extra $1,378 to show for your efforts can get you excited about planning for bigger goals, like retirement.

The 52-week savings challenge is simple enough that even the most beginning savers won’t feel overwhelmed when trying to reach their end goal.

The most difficult part is getting started. But once you do, you might find that it’s easy to save when you’re doing it in small amounts. So if you’re ready to save more next year, now could be a perfect time to get a head start on this $1000 dollar challenge.

Before you go, be sure to check out my favorite Smart Money Tools for making and saving money.

Want to track your savings progress? Download these free printable money-saving charts!

Need more money tips? Read these posts next:

- How to Track Spending Every Month and Never Blow Your Budget Again

- 50 15 5 Rule: How to Save More and Spend Less

- Save Money Live Better (20 Easy Ways Save More This Year)

- How to Save 10000 in a Year [Simple Tips That Really Work!]

- How to Do the 50 Envelope Challenge (Printable Envelope Savings Challenge Tracker!)